Point #1: Transparency

Aside from interest rates and principal amounts, additional benefits from your lender also make a difference.

MONEYME understands the importance of transparency on surgery loans and other credit products, and that’s why we pride ourselves on providing borrowers with all the crucial information upfront, from repayment terms to interest rates.

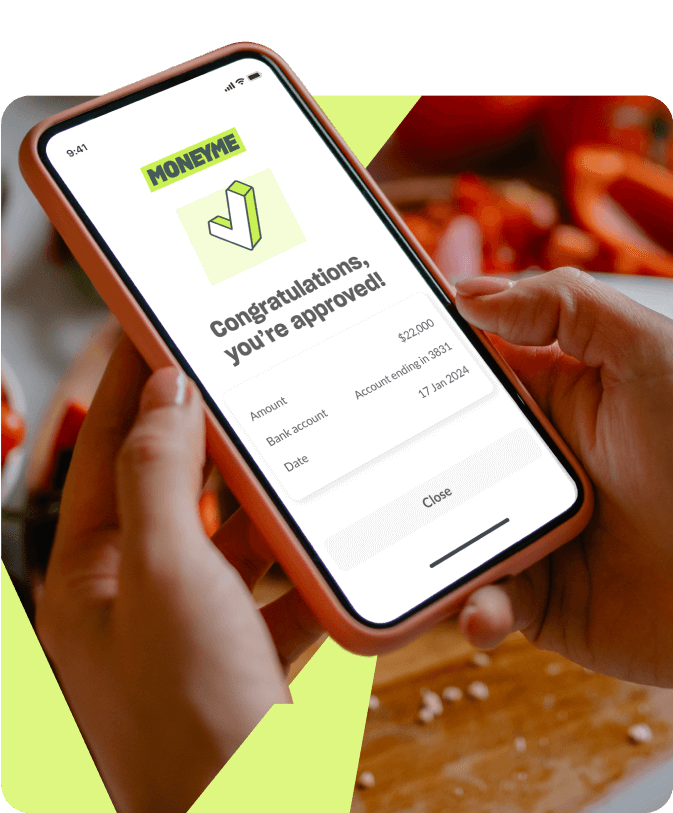

What’s more, you can stay on top of payments and view your personal loan balance through our mobile app.

Point #2: Requirements

Depending on the lender, borrowers may have to potentially tie up an asset (property, car, etc.) as collateral when taking out a bank loan for surgery. This is so the lender has security or a form of backup payment, which will be needed in case the borrower cannot make repayments.

However, MONEYME recognises how overwhelming these medical finance criteria can be. It’s why we offer unsecured personal loans for cosmetic surgery and other medical procedures with no collateral required.

To apply for our loans, you simply need to be:

- at least 18 years old;

- a permanent resident or citizen of Australia or New Zealand; and

- earning more than $30,000 annually from employment.

Point #3: Repayment terms and more

When it comes to a personal loan for surgery, some of the most important aspects are interest rates, loan duration, and other terms. Some lenders may offer higher interest rates, limited term options, and even impose early repayment fees.

At MONEYME, we want to make loans easy to manage which is why we offer low interest rates. Our customers can also choose whether to pay off their loans in three, four or five years. What’s more, we don’t charge early repayment fees. This means you can save on interest rates in the long term if you pay off your loan ahead of time.

Point #4: Application process

Depending on the provider, a bank loan for surgery procedures can include time-consuming forms and paperwork.

As for lenders like MONEYME, you can experience a convenient and straightforward application process. You can rest assured that our advanced technology thoroughly assesses your details for a comprehensive decision. Beyond just your raw credit score, we’ll also take into account any debt obligations, sources of income, living expenses, and more.

No matter if it’s a personal loan for plastic surgery or a different medical treatment, we give you the opportunity to apply for the funds you need from the comfort of your own home.