A low rate credit card usually means that the credit provider is offering a lower than usual interest rate. Choosing a low interest rate credit card option can be a great way to help you save on credit costs but it’s not the only feature or perk worth keeping an eye out for when you’re searching for a great credit card. Other benefits include interest-free periods as well monthly and annual fees, how fast your application process takes and how easy it is to manage your credit with your new provider.

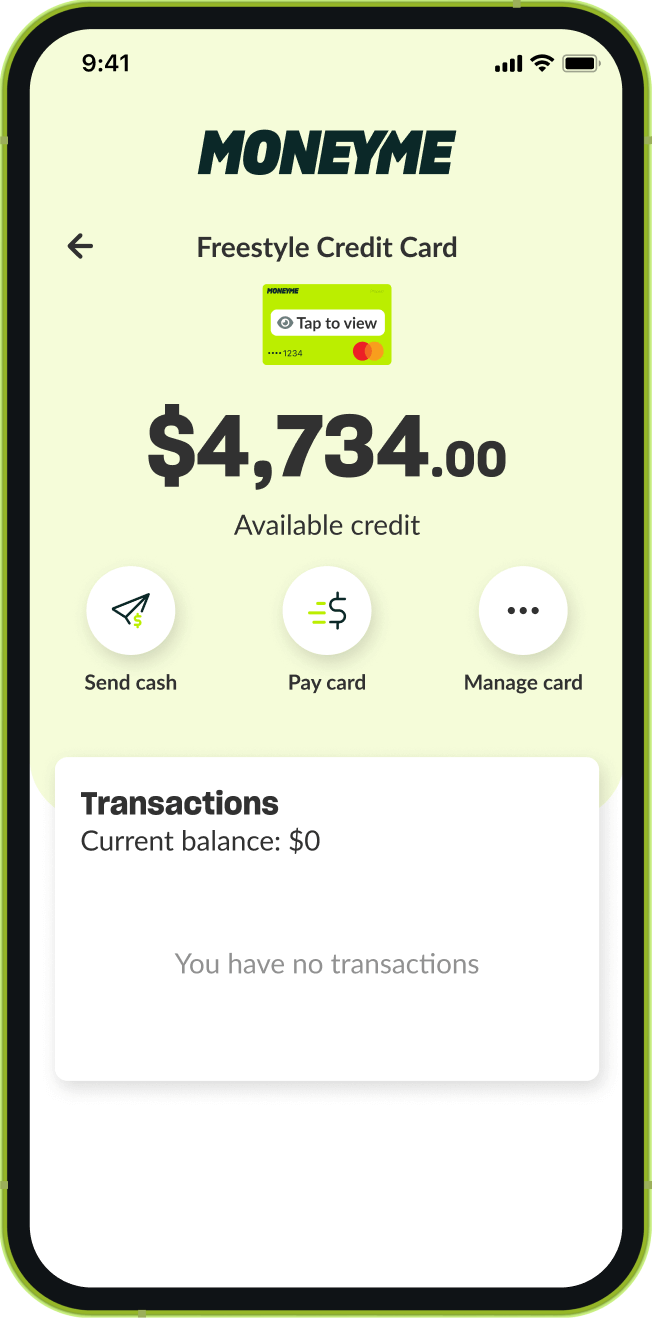

When you choose MoneyMe and our Freestyle virtual Mastercard®, you’re not only accessing competitive rates on your credit card, but you can also get up to 55 days interest-free on purchases that you make. Popular buy now and pay later options offering interest-free repayments usually take 4 fortnights to repay. This equates to 42 days interest-free. The Freestyle Mastercard offers you up to 55 days which means you get almost an entire extra fortnight. When you repay your credit balance within this period you are essentially using an interest free credit card.

Because our instant approval credit card is powered by Mastercard you can use almost anywhere while buy now and pay later options can be limiting, applying to only a select number of stores or, worse still, only a minimum amount. Some stores will only allow you to use a payment method like this if the cost of the item you’re purchasing is above a certain amount. With Freestyle, your interest-free period applies to all purchases that you make both in store and online.

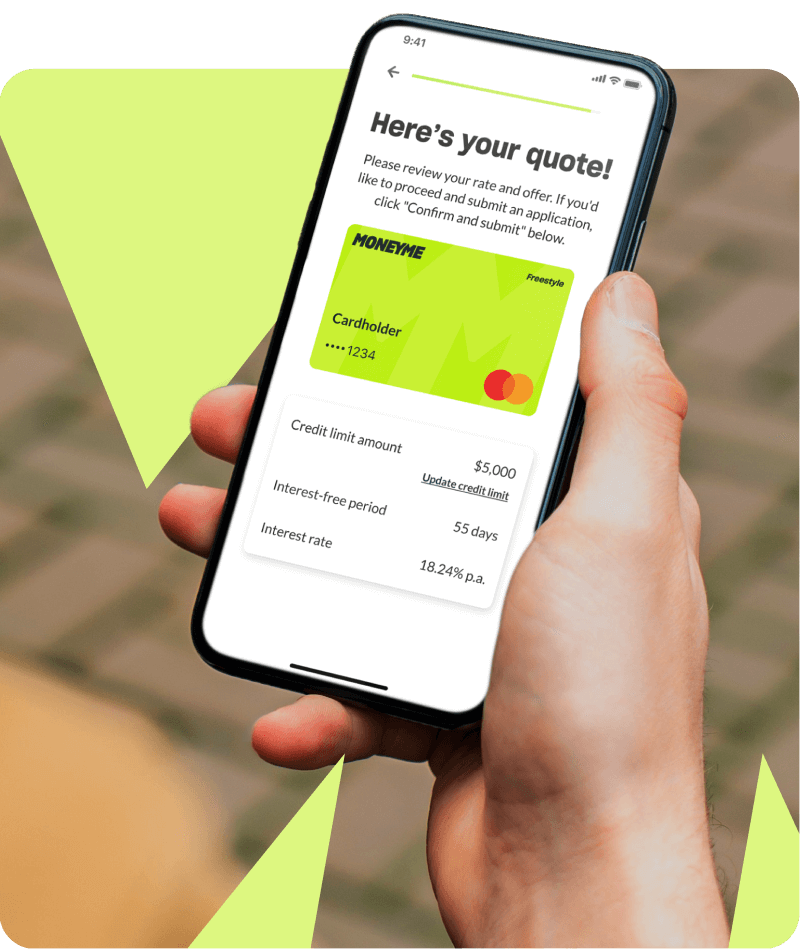

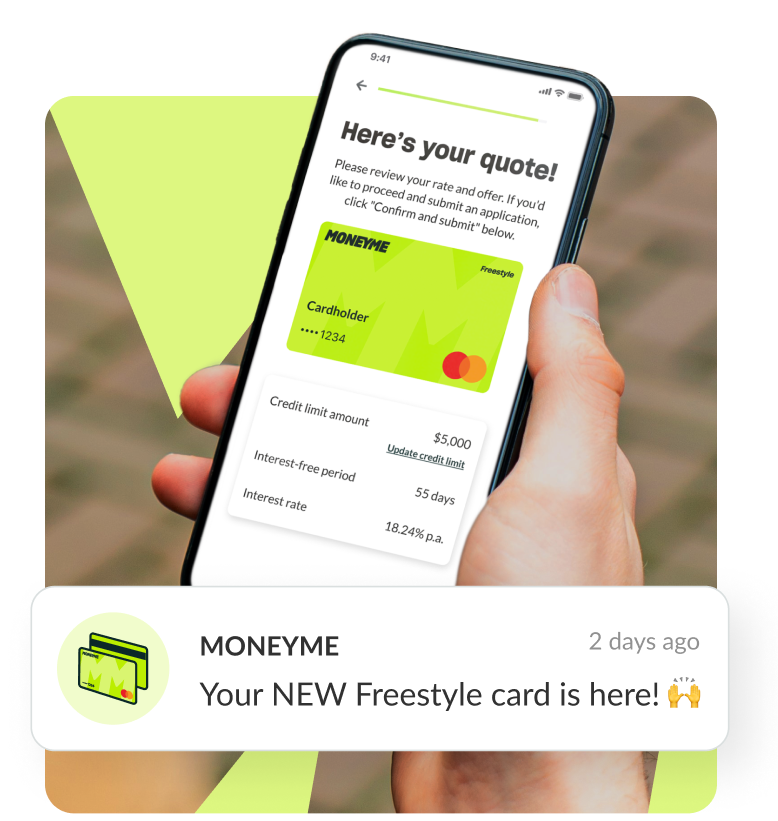

Another great feature of the Freestyle online credit card is how quick and easy it is to get your hands on fast cash from us. We specialise in offering low doc personal loan applications and fast approval credit cards. Because we are a wholly online lender, everything you need takes place online. It only takes a matter of minutes to complete and submit a credit application with us, whether that’s for our instant approval credit card or any of our personal loan products. We don’t need lots of irritating paperwork and we probably won’t even need to call you to talk about your application. Instead, at the end of your application, you’ll be asked to input your online banking details with us. This gives your personal loan broker or your credit application assessor access to a read only PDF format statement of the last 90 days of bank transactions. We use this to instantly verify your application details like your salary and your living expenses and it’s the reason why we can offer such fast turnarounds on our applications.

When you apply for either a variable rate personal loan or our Freestyle virtual Mastercard® during our business hours then you can usually expect to have your new funds available the very same day, depending on who you bank with.