Getting a new credit card can be a fun and exciting moment. If you have a clear idea of exactly how you are going to use your new funds, then it’s time to start putting your plans into action. Credit cards can be a useful source of emergency funding to cover things like unexpected expenses. When the car breaks down or you need to buy an emergency flight, knowing you have access to quick cash loans from your credit line can give you a lot of peace of mind.

Of course, not all last-minute spending needs to be an emergency. Sometimes a great deal for a weekend away comes up and you might not have the cash to cover it. Using your new credit card can help you take advantage of last-minute sales and great offers. Once you have purchased your amazing deal, take some time to work out how you are going to repay your credit funds so that you know you can take advantage of another amazing deal in the future.

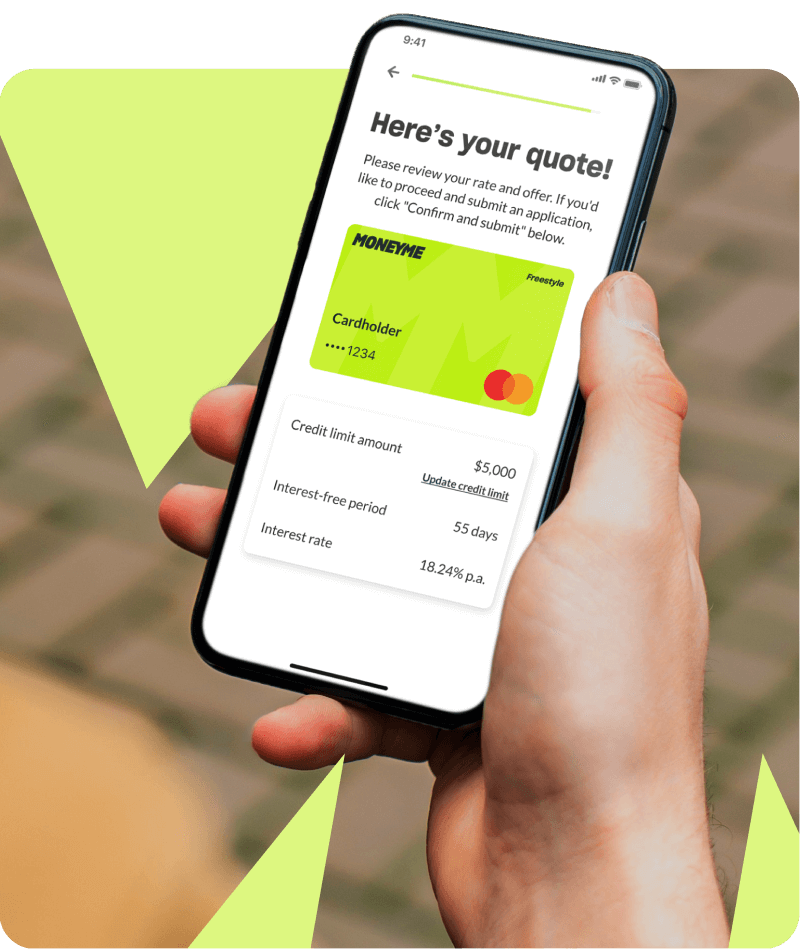

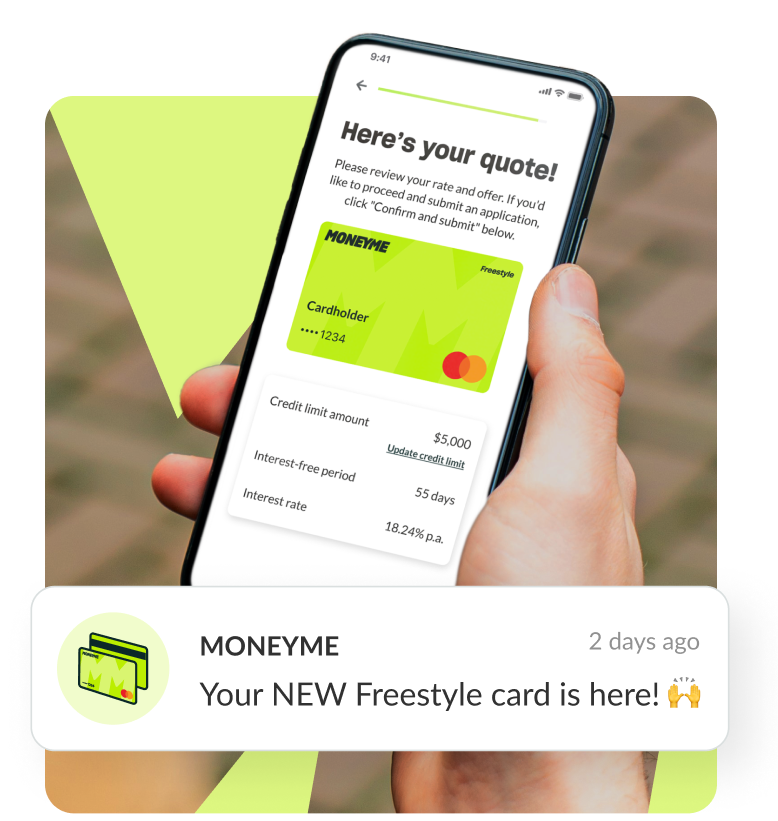

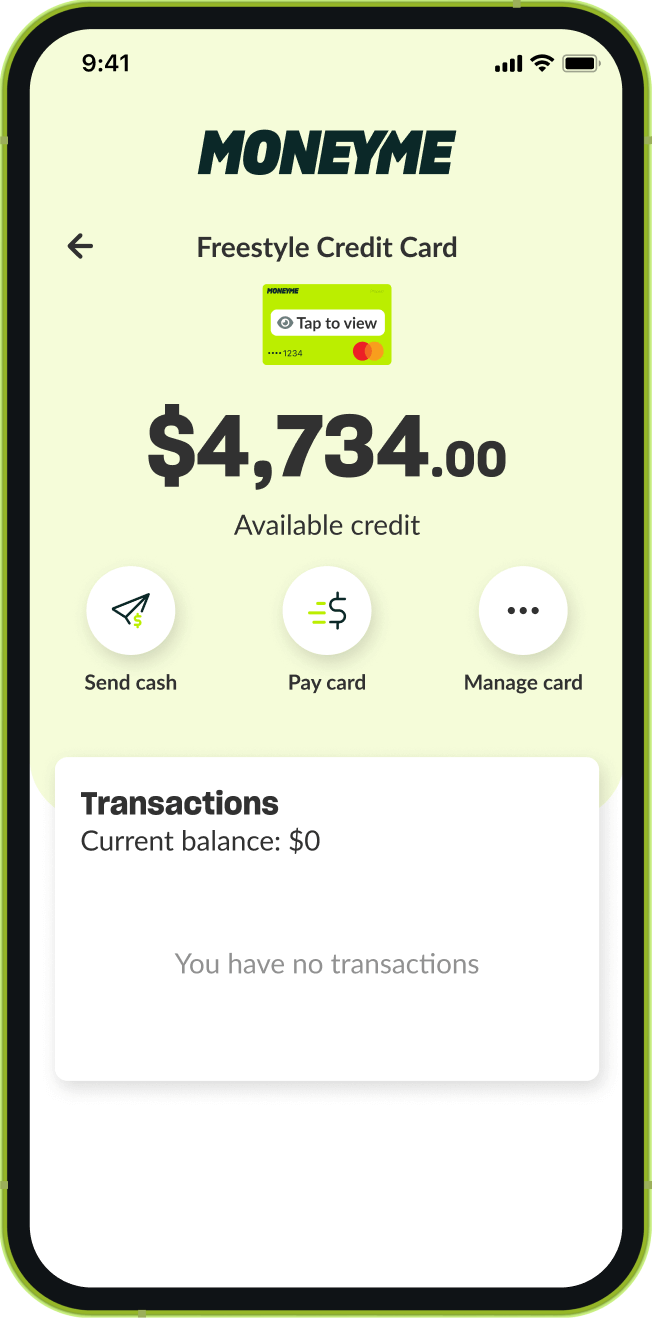

New credit cards can also be a useful way of monitoring your monthly expenses. If you choose to use your credit card as your everyday purchasing account for things like groceries, petrol, and entertainment like concert tickets or subscription services then you have a clear spending budget already. Remember that MoneyMe customers with a Freestyle account have access to 55 days interest free on purchases made. This can help you to develop a clear expenditure budget and monitor it closely. When you repay the expenses that you have put on your new credit card then you don’t pay interest on those purchases.

There are lots of great tools online to help you budget and manage your new credit card too. Using things like a credit card calculator can assist with planning your repayments and show you how long it will take you to repay your balance using both minimum monthly repayments that your credit provider sets or by increasing those repayments to something more you can afford, and which will help you avoid higher interest over the long term.

Credit card interest is calculated daily and even without a handy online calculator, you can work out the total interest charged on your balance with a manual calculator and a few quick moments. First, convert the annual interest rate from a percentage to a decimal format. You can do this by dividing the percentage amount by 100. Now divide that annual rate by 12 (i.e. monthly) and then times it by the total amount you have borrowed. You can convert that monthly rate back to a percentage by multiplying it by 100.