Streamline repayments – Getting a debt consolidation loan to pay off multiple debts reduces the number of payments and interest rates you deal with every month. And if you have only pay for one debt each month, the risk of missing a due date significantly decreases. This also gives you a clearer picture of when all of your debts will be paid off.

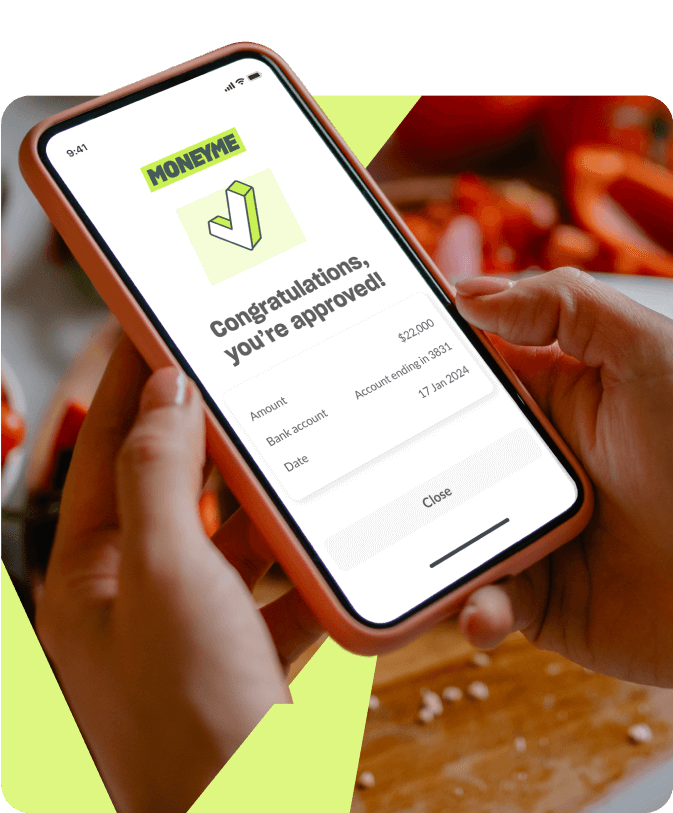

Pay off debts sooner – There are chances of acquiring a lower interest rate when consolidating your debts. You can leverage this by making extra repayments each month so you can pay off your debts earlier and save more on interest.

Improve credit score – Your credit score may take a temporary dip during an enquiry, but it can also improve in the long run so long as you make on-time repayments. Your payment history will reflect in your credit report, so it pays off to try to pay on time.