About MONEYME

Click on a category to see options

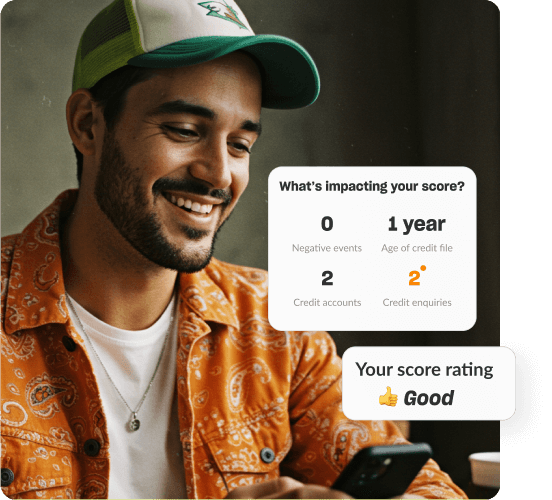

Get in-depth insights

See what's on your credit file, how it's impacting your score and what you can do about it.

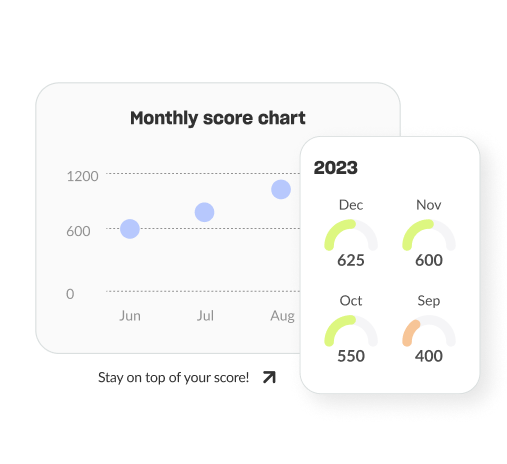

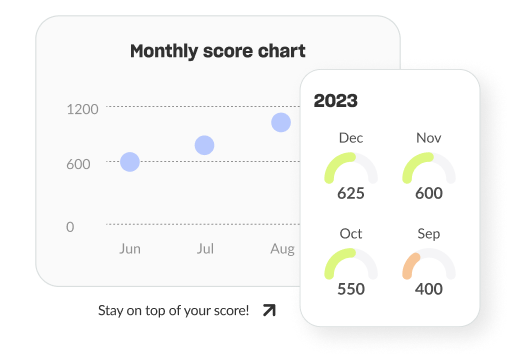

Track your progress

We keep track of your score history so you can see how your score changes over time. Watch it improve or spot when something has impacted it negatively.

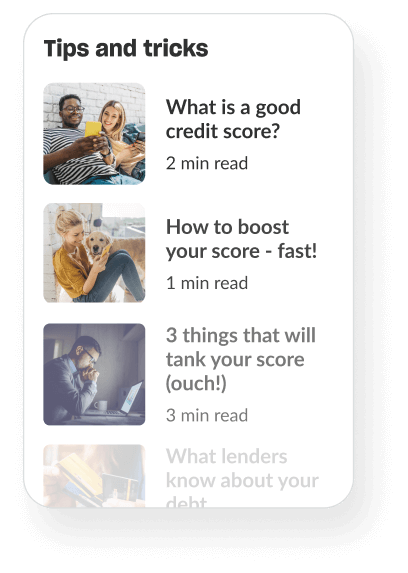

Boost your knowledge

Learn all there is to know about credit scores. We share useful tips and tricks on how to boost your score, how to avoid the common mistakes that will tank it, and much more.

Free credit score check provider

If you’re looking for a free credit score check in Australia, then download the MONEYME app. Simply register your details to access your free credit score and discover ways to improve it. With our app, you can view, track, and boost your credit score over time - and for free! We offer plenty of tips and insights to help you learn more and build your financial health for easier access to affordable credit.

In fact, the average MONEYME customer typically has a ‘very good’ or ‘excellent’ score with our free credit score Australia service. Download the MONEYME app today to take control of your finances!

Award-winning lender

What our customers say

With no impact to your credit score

Use our free credit score check

Our free credit score Australia check is quick and simple to use, like all MONEYME services! Simply:

- Download our app and register your details securely.

- View your private credit score, so you know what lenders can also see about you. These checks count as a soft score, so they don’t impact your credit rating.

- Discover free insights and tips to help you master and improve your credit score.

- Track your progress and improvements over time as you continue to monitor your credit score and take control of your finances.

The MONEYME team is just a quick call away for queries. We pick up in 8 seconds!

A different kind of lender

Quick quotes, fast approvals

We cut out unnecessary paperwork and delays with lending that's fast, simple, and built around you.

Transparent and flexible

No lock in contracts, hidden fees or surprises - just flexible options that keep you in control.

Real support, real fast

Speak to a real person if you have questions, we usually answer calls in seconds.

For people and the planet

We care about our social and environmental impact, and we're proudly B Corp Certified.

With no impact to your credit score

Purpose-driven

and responsible

At MONEYME, we're not just here to provide low rate loans - we're here to make a difference. We believe in providing smart, responsible lending that keeps you financially on track, whilst doing good for the planet.

As a Certified B CorporationTM we're big on sustainability. We hold ourselves accountable to the high standards of the B Corp movement, supporting renewable energy projects, doing our part for the community, and striving towards a greener future.

Explore our impact

*This comparison rate is based on an unsecured variable rate personal loan of $30,000 for a term of 5 years. Rates displayed are for customers with an excellent credit history, where a $0 establishment fee applies. For other borrowers, an establishment fee of $395 or $495 will apply, based on loan amount. A $10 monthly fee applies to all personal loans. WARNING: This comparison rate is true only for the example given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate.