So how do you answer ‘What is a good credit score?’ in Australia?

Within each credit scoring agency, the higher the score, the better. As for the question ‘How is credit score calculated?’ both illion and Experian calculate credit scores between 0 and 1,000, while Equifax scores within a range of 0 and 1,200.

The three main credit reporting agencies in Australia rank their credit scores slightly differently, so to see what range (such as excellent, very good, average, fair, and below average) your specific credit score falls into, you’ll need to check with the particular credit reporting agency.

Your credit score changes over time, so if you’re thinking about how to improve credit score numbers on your report, there are several things you can do.

First of all, you must pay your utility bills by their due date and make all loan and credit card repayments on time. If you are unable to keep track of your repayments, you may even want to consider consolidating your debts for easier loan management. You may also hurt your credit score if you apply for too many loans.

So are there other ways of answering ‘How is credit score calculated?’ In a way, yes. Some lenders also use an internal credit scoring system when assessing your loan.

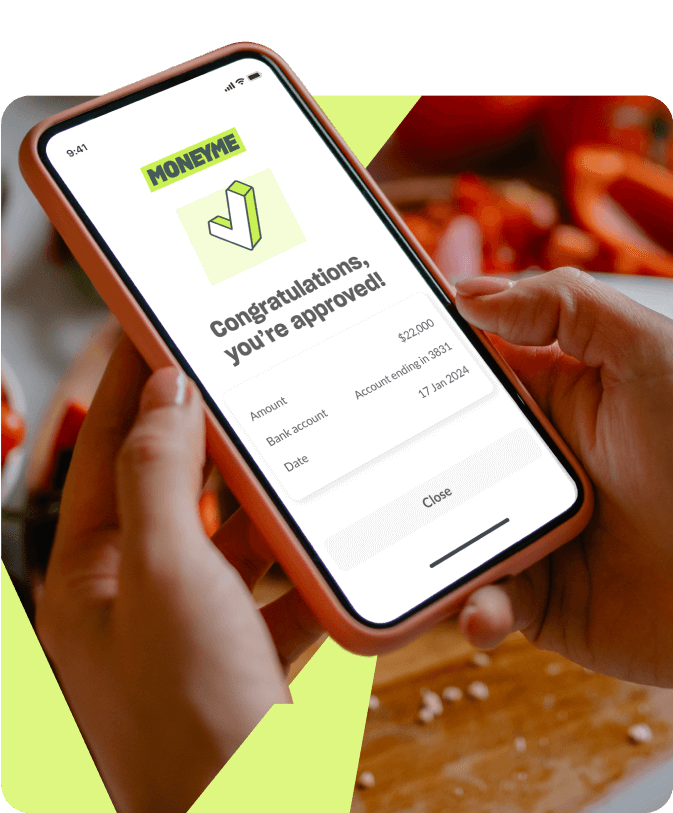

For example, MONEYME has a rating scale from A1+ to A5+ that is assigned to customers. If you’d like to know how to increase credit score numbers with MONEYME, one method is to make all your repayments on time. This will help improve your score for the next time you apply for a MONEYME loan and may even offer you a lower rate on a loan you desire.

The Australian Securities and Investments Commission’s MoneySmart website has more information about credit reports, how they are calculated, and how to improve them.