Applying for a line of credit Melbourne is easy with MoneyMe.

All you’ll need to apply with us is two forms of Australian government-issued identification, such as a passport, driver’s licence, medicare or proof of age card. Once you’ve got these handy, hit ‘Apply Now’ using our smartphone app or visiting our website online.

We utilise the latest secure lending technology to verify all the finance information we need online and process your application in real-time. Our credit card fast approval process is 100% online and doesn’t mess about with documents like payslips. When you apply for a line of credit with us, there's no paperwork, no phone calls, no fuss!

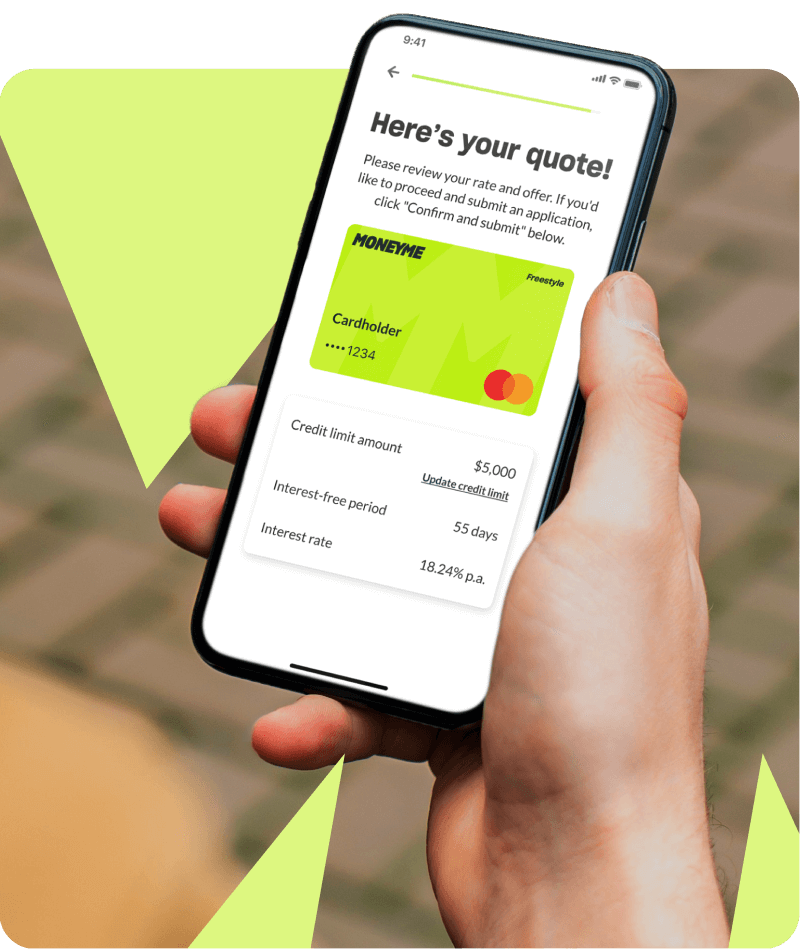

We’ll first ask you about your preferred Freestyle virtual Mastercard® credit limit. Once we know that, you’ll need to tell us about your employment and income, daily expenses, and any debt or liabilities, savings, and assets.

We’ll then run a credit check before asking you to sign in to your online bank platform. It’s important to note that we don’t receive access to your account - our online finance management system simply requests transactions from the last 90-days in PDF read-only format from your bank.

Together, this information helps us to determine the best line of credit loan limit for your financial circumstances. The amount of credit we offer to make available to you and at which line of credit rates is contingent upon your honesty and transparency when completing your application and on your recorded credit behaviours.

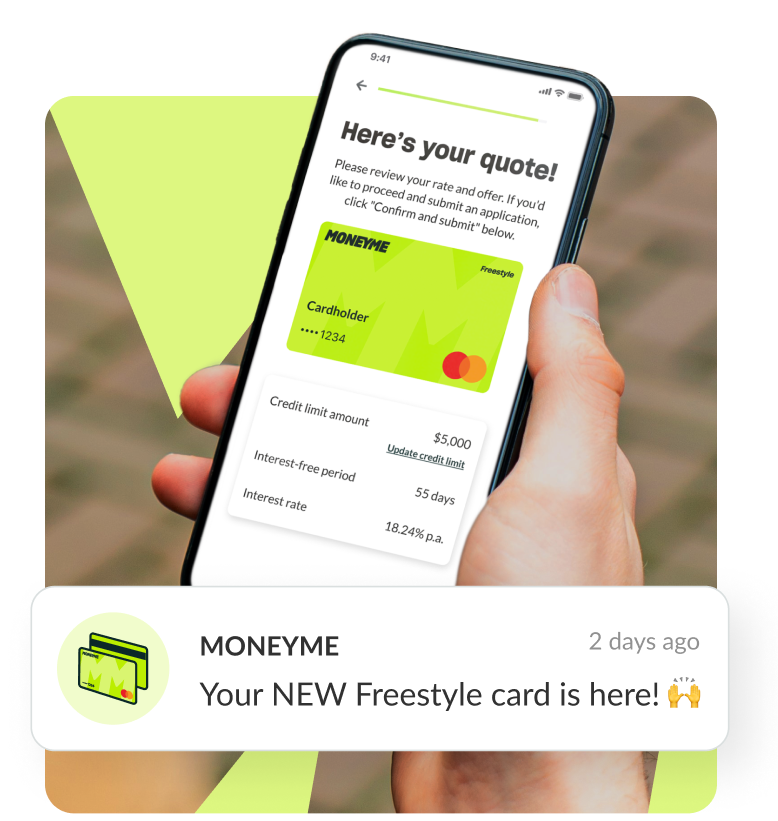

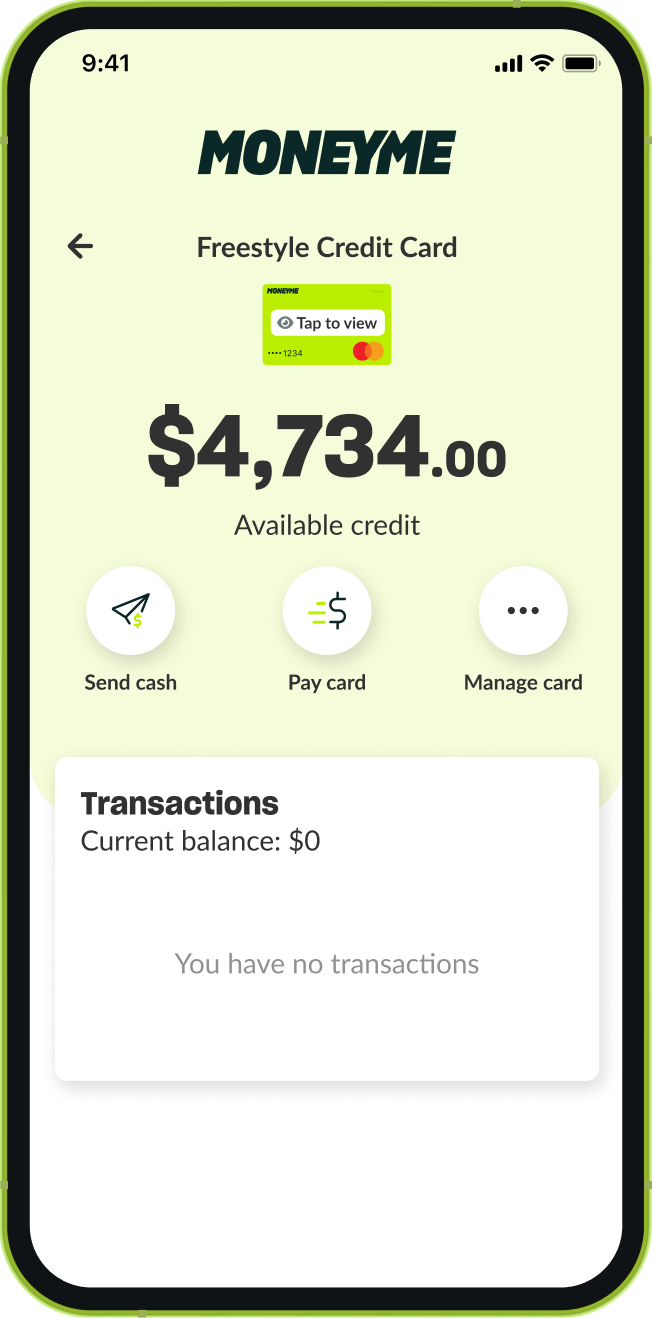

Gone are the days of agonising waits - you’ll know almost immediately if you’ve been approved for our Freestyle virtual Mastercard® and, assuming you’re successful and applied within business hours, you’ll have access to your line of credit Melbourne funds immediately.