Applying for a MoneyMe loan to fund your kitchen renovation is easy. You can visit us online or via the MoneyMe App and complete a 100% paperless loan application in just a few short minutes.

First, we’ll ask you about how much you’d like us to lend you to support your kitchen renovations - and any other renovation costs you’re considering like a bathroom remodel, veranda cost or wood heater installation cost - and over how long. You can use our nifty online calculator to compare repayments on different loan amounts and lending periods.

Once you’ve confirmed that, you’ll need to tell us about your employment and income, daily expenditure, and any liabilities, savings, and assets.

As a part of the assessment process, we’ll then review your credit history using the new reporting methodology. Whereas previously, your credit file only reflected any negative activities, such as where you may have missed a bill or defaulted on a line of credit, the new, comprehensive method of credit reporting allows us also to see your positive credit behaviours. This means all your regular, on-time repayments are recognised, creating a much clearer, fairer, and more positive borrower profile.

Once you’ve completed the online loan application form, we’ll ask you to sign in to your online bank platform. It’s important to note that we don’t receive access to your account - our system simply requests a 90-day transaction statement in PDF read-only format from your bank. After receiving it, our online loan management system will use it to confirm the information you provided around income, existing debt, and other expenses listed in your application.

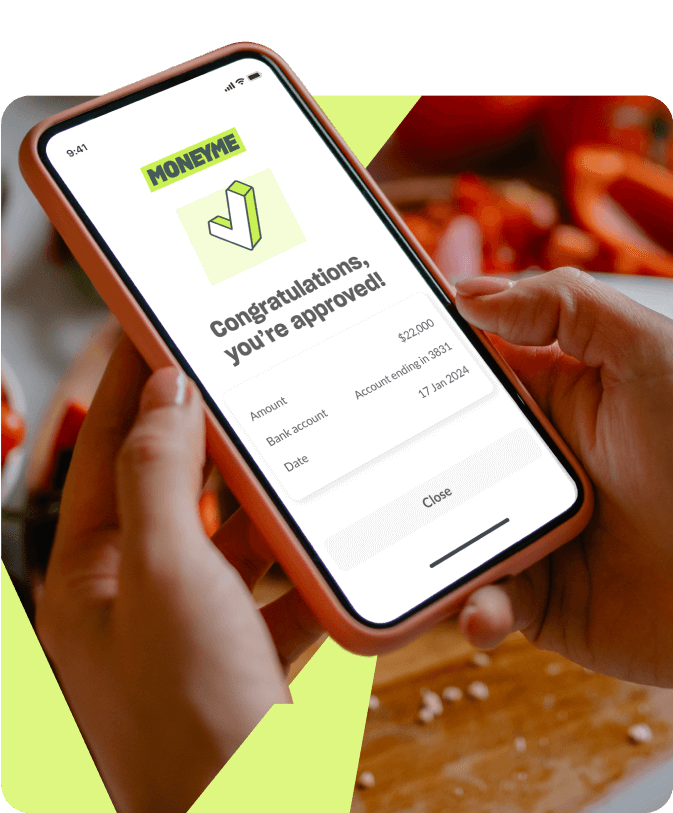

We offer unsecured personal loans between $5,000 - $50,000 at competitive rates, with a quick response time and funds delivered to most accounts the same day. To be eligible to apply, you’ll need to be at least 18 years of age and an Australian citizen or resident for tax purposes.

So, if you’re ready to get cooking, hit ‘Apply Now’ on the MoneyMe website or app, and you could have the cash for your kitchen renovation in your account the same day.