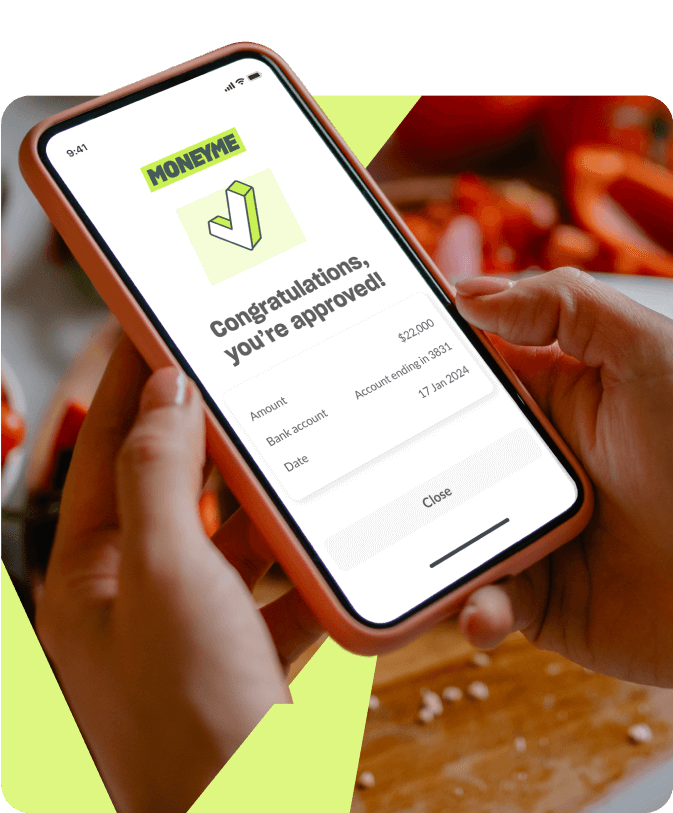

Applying for an auto loan with MONEYME is easy as you can do it in the comfort of your own home. Our online application only takes a few minutes to complete, and you’ll get an instant decision.

If you’re ready to get started, all you need to do is complete our online application form. We’ll ask you for some basic information about yourself and your financial situation. You will also be required to indicate your preferred loan amount and loan duration.

Once you submit your application for our auto loans, we’ll conduct a thorough assessment. This helps us ensure that we can offer you a loan that is suitable for your needs and that you’ll be able to repay it comfortably.

If you qualify, one of our expert loan consultants will be in touch to discuss the best car loans for your situation. We’ll work with you to find a loan that suits your needs and budget. If your application is successful, we’ll transfer the funds to your nominated bank account straight away, so you can start shopping for your new car!

We’ve been helping people navigate the world of auto financing for years, and we know exactly what it takes to get the best possible rate. We’re here to help you every step of the way, from start to finish.

We offer truly independent and tailored advice to our clients, so you can be sure you’re getting the right loan for your new or used car. And because we’re the experts, you can rest assured that you’re in good hands. So if you’re looking for the best car finance deals, make sure you come to MONEYME.

If you have any questions about our auto loan products, or anything else, our team is always happy to chat.