If you’re looking for less than $5,000 in cash, then a cash advance credit card option might work best for you. A quick injection of cash can come in handy for covering emergency costs like urgent home repairs or mechanical repairs. It can even help you out covering your rent or other regular payments when your finances are a bit stressed like around the holiday seasons or when you’ve been ill and haven’t been able to work.

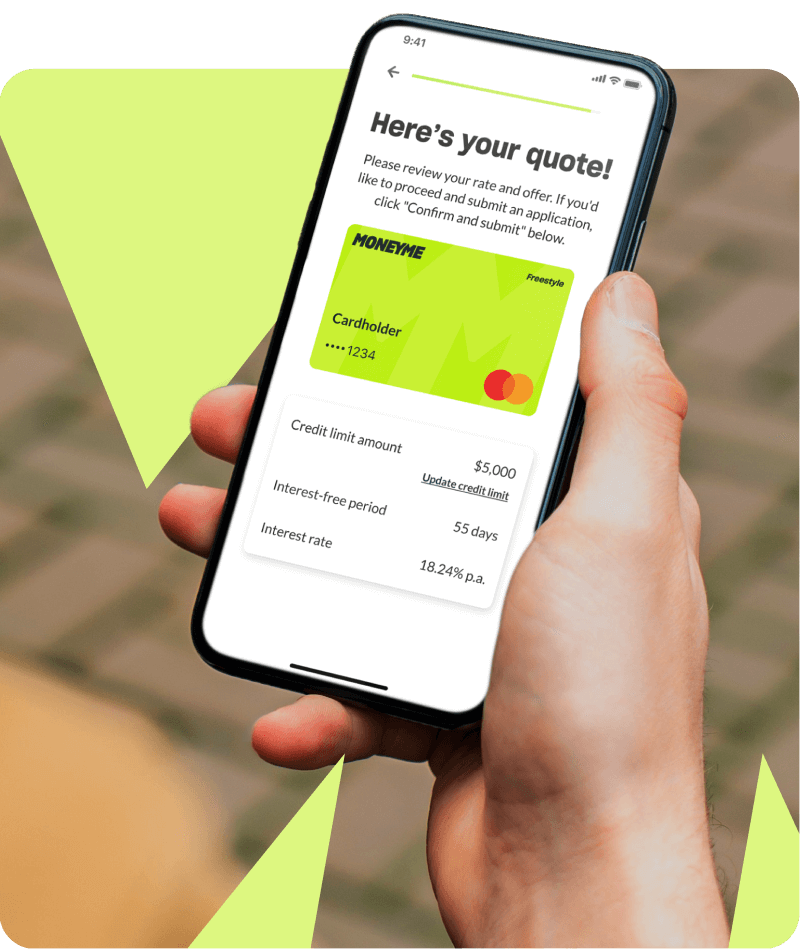

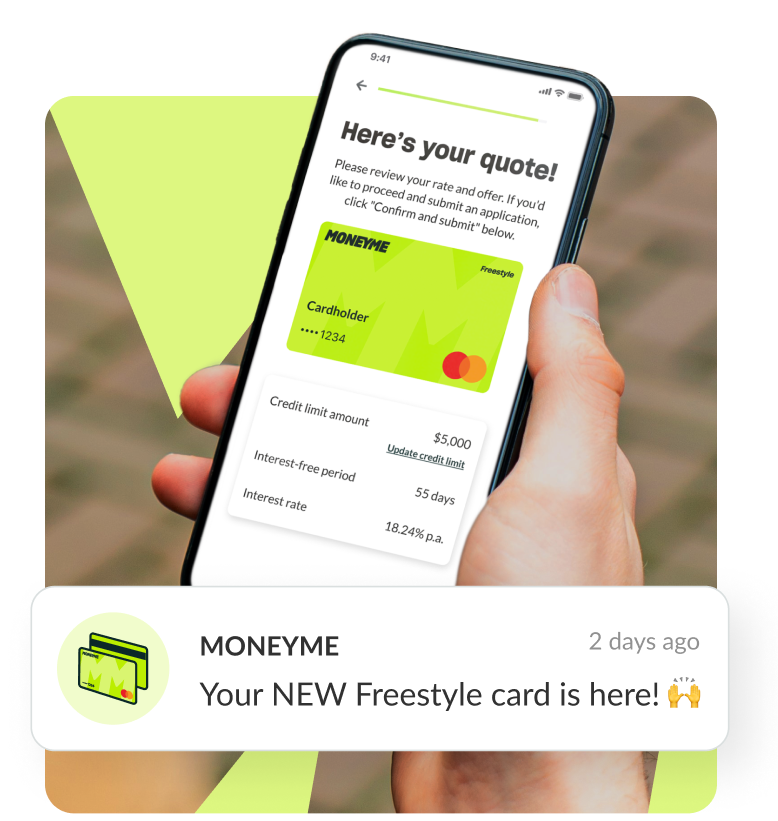

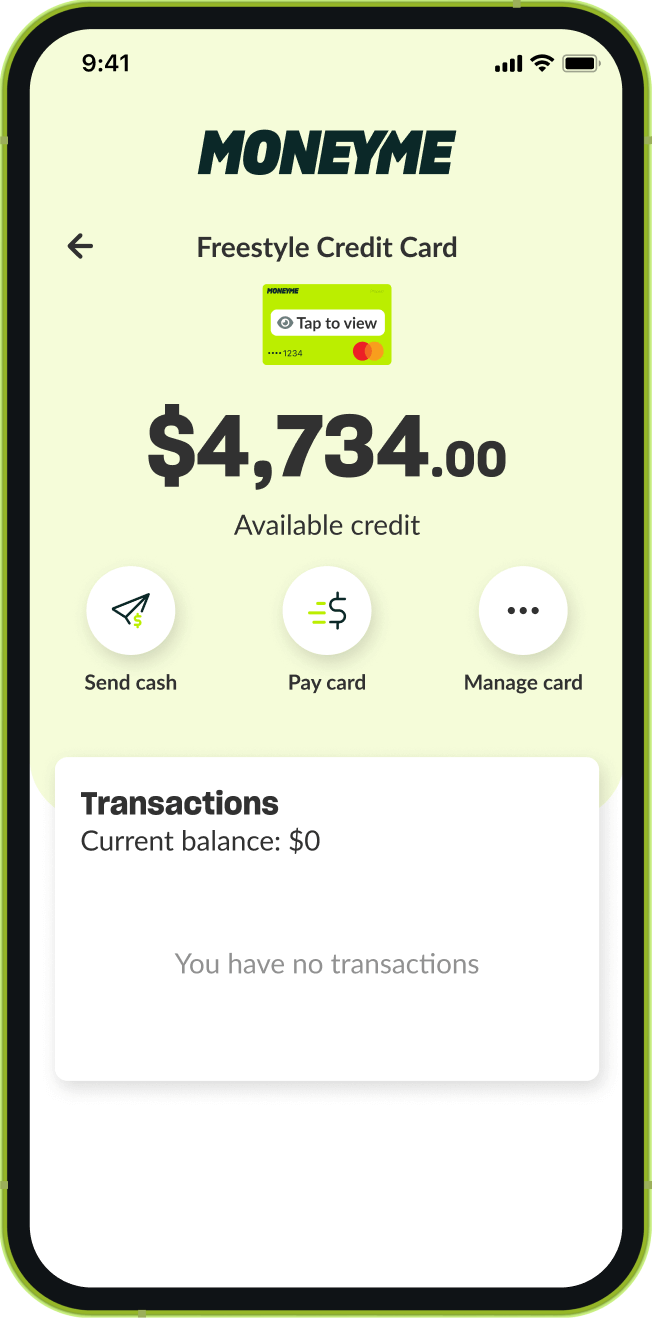

MoneyMe offers customers the Freestyle virtual Mastercard®. Like any other credit card, it gives you access to a revolving line of credit for balances between $1,000 and $5,000. Unlike other providers, however, our credit card doesn’t live in your wallet with the other plastic cards; it lives in your smartphone instead. Use it to pay for purchases in-store using Tap n Pay or for shopping online and paying your everyday bills online in a breeze. You get up to 55 days interest-free on purchases made which means that if you repay your credit funds within that period, you’re essentially using an interest-free credit card.

There is also the added benefit of drawing cash from your Freestyle account. The Freestyle fast approval credit card offers you endless funds to draw on up to your pre-approved amount. Every repayment frees up new credit you can use again. If you need a little cash boost between paydays, then you can transfer money using the cash advance credit card option to your normal account and withdraw it instantly.

We’re a fair and responsible money lender so everything you need to know about drawing cash from your Freestyle account is available to view on our website, including our full schedule of fees and charges, as well as the cash advance interest rate. It’s a good idea to know exactly how much a cash advance from your credit card will cost you before you choose this option. For example, everyday purchases you make with the Freestyle Mastercard from MoneyMe come with up to 55 days interest-free, but your cash advance does not. You are charged the annual interest rate immediately and until the cash advance amount has been repaid to your credit card.

If you can use your Freestyle account to pay for what you need instead of drawing cash, then this is definitely the cheaper option but when you can’t, you know that Freestyle is there and available. It might be a good idea to prepare a repayment budget before you draw your extra cash so you know how much it will cost you and how long it will take you to pay it back.