How To Increase Credit Score Fast

So you’re on a mission to find out how to increase credit score fast. Some purchases become inevitable at certain points in life, but we may not have the liquidity to make these purchases outright.

For instance, you may need to fund the health expenses of a loved one with an illness, so you’re looking into a personal loan. Or maybe you can only get to work with a car, and your current set of wheels costs more to repair than to replace. Maybe you just need help with an expensive item and would like to secure a credit card with a higher limit so you can get the item in instalments.

Clearly, there are a multitude of reasons you want to know how to increase credit score fast. Your credit score, after all, is a reflection of your past borrowing and repayment habits, and it’s how you can obtain further credit.

Borrowers’ credit scores are often taken into account when determining whether to approve their loan or credit card application. Since credit scores are a measure of your creditworthiness, higher credit scores increase your chances of getting credit on more favourable terms.

On the other hand, some credit products, such as loans for low credit score holders, tend to come with difficult repayment plans and higher interest rates, making it even harder for already struggling borrowers to become debt-free and attain financial freedom.

So it’s no surprise that many want to know how to increase credit score fast. Here at MONEYME, we want to help you learn how to improve your credit score as well as give you a realistic timeline on how quickly you can increase your odds of getting approved for credit.

Is it possible to increase my credit score overnight?

So how fast does paying off debt increase credit scores? We know you want to learn how to increase credit score fast, so we’ll just get right to the point: no, it is not possible to significantly increase your credit score overnight. It takes consistency and, above all, time to build and improve your credit score.

Credit scores are usually calculated based on a variety of factors, like your payment history, length of credit history, types of credit, and more. And calculating your credit score involves evaluating these factors over time, usually over months or years.

For those who want to know how to increase credit score fast in time for a favourable credit application result by next month, a significant or notable increase in such a short time period is highly unlikely. But don’t lose hope – there are several things you can do to improve your credit score in Australia over time

What are some easy ways to improve my credit score?

While there may not be an immediately satisfying answer to how to increase credit score fast, you can undertake a few key measures to improve your score gradually. An important part of building a good credit score is consistently making on-time payments. Make sure you pay all your bills by the due dates to avoid a negative impact on your credit score.

Also, when it comes to credit cards, try to make sure you don’t use more than 30% of your available credit. You can improve your credit score by paying down your balances and using credit sparingly.

Another thing you’ll want to avoid is opening too many new accounts, especially within a short period of time. This can be viewed as a red flag and can negatively affect your credit score. Limit new credit applications, as the number of credit enquiries or hard credit checks done by potential lenders in the past can be viewed on your credit report.

If you’re looking up how to increase credit score fast, you’re probably wondering how you can view your credit score in the first place. After all, you need a baseline figure to see how much more it has to improve before you can try your hand at a loan or credit card application.

Where can I request a copy of my credit report online?

‘So how do I check my credit score?’ you might wonder. You can see your credit scores for free once every three months from each of the major credit reporting bodies like illion, Equifax, and Experian. They collect and store financial data about you. Then, they use the data to generate what is called your credit report and calculate your credit score, which lenders then use to assess how risky you are as a borrower.

There’s a simpler way to stay on top of your score, though!

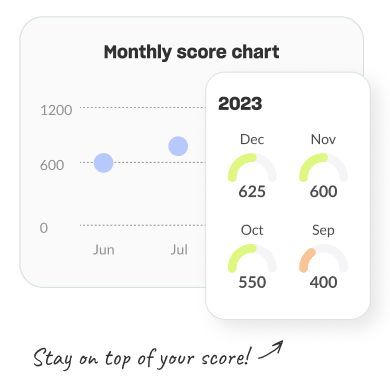

Through the MONEYME mobile app, you can get your free, fast, and personalised credit report thanks to the MONEYME Credit Score tool. With this service, you’ll be able to access the same information that banks and lenders use to evaluate your creditworthiness, along with tips and tricks to improve your score. Plus, we have special offers in store!

The best part is that while you can’t increase your credit score overnight, you can use our monthly progress tracker to see how your credit score changes each month. This graph will give you an easy view of increases in your credit score compared to previous months and provide you with a sense of accomplishment when you maintain good repayment behaviour.

In summary, improving your credit score takes consistent, positive borrowing behaviours over time. You can get your credit scores to track your progress and get a better hold of your personal finances with the MONEYME Credit Score tool.