If you’re wondering why it’s important to know how to improve a credit score, it is significant for a number of reasons.

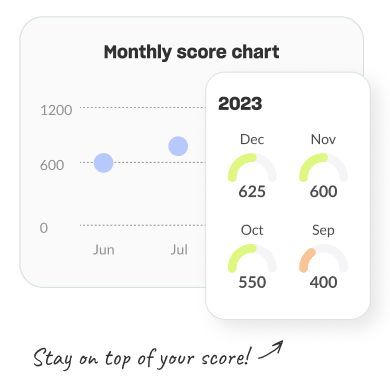

A credit score is a numerical representation of your credit history. It is calculated by a variety of factors, including payment history, amount of debt, length of credit history, types of credit accounts, and number of hard credit enquiries.

A good score generally demonstrates to lenders that you are a responsible borrower who pays their bills on time and in full. It shows that you are managing your finances well and that you can handle credit.

Since it is a measure of your creditworthiness, a good score can help you qualify for loans, mortgages, credit cards, and other types of credit. It can also put you in a better negotiating position for lower interest rates and better credit terms.

Additionally, knowing how to maintain and improve a credit score can make it easier for you to obtain rental housing, certain types of insurance, and even employment.

By obtaining lower interest rates, you can pay off your debts faster and possibly save money in the process. Additionally, by encouraging you to make payments on time and in full, you can prevent late fees and other penalties that can cost you more.

Finally, having a good credit score provides a sense of security. Knowing that you can get the credit you need when you need it can give you peace of mind. It can also make it easier to plan for big purchases, such as a home or a car.