There’s probably a reason you want to find out how to view your credit score. Perhaps you’re interested in buying a new car and are looking into financing options. Maybe you’ve been thinking about getting a better credit card that can give you a higher cashback percentage. Or you’re coming off a not-so-perfect year financially and want to get back on track.

A credit score is essentially a representation of your financial situation, almost like a portfolio of your borrowing behaviour. Credit scores range from 0 to 1,000 or 0 to 1,200, depending on the credit reporting agency, and are among the indicators of the state of your finances.

It’s important to know how to view your credit score because it is used to measure your creditworthiness. A good credit score can spell the difference between approval and rejection on applications for a mortgage, car loan, personal loan, and more. When it comes to credit applications, a higher credit score means you’re more likely to have higher borrowing capacities.

The benefits could possibly extend to lower interest rates, more favourable repayment terms, or insurance premiums that are easier to handle. Employers in certain industries might also look at a potential applicant’s credit history, especially if the job they’re applying for involves handling finances or sensitive information.

Finally, another perk of a great credit score is, well, the perks. Most credit card issuers reserve their premium offerings, such as travel rewards cards and cashback cards, for consumers with good credit scores. These usually come with additional benefits like airline lounge access, concierge services, or travel insurance.

On the other hand, those with lower credit scores may have to contend with repayment terms that are difficult to handle – or get rejected from a credit application altogether.

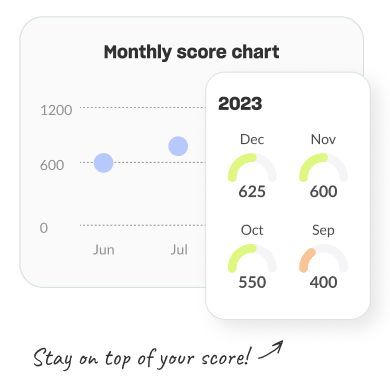

Here at MONEYME, we want you to have access to the information you need to improve your financial health. So here’s how to view your credit score and how you can track its progress over time to make that number even more appealing in time for your loan or credit card application.