Your rating is based on multiple factors, and if you’re learning how to improve your credit score, understanding these factors is crucial. In Australia, you can access your rating from credit reporting agencies (CRAs) like Equifax, Experian, and illion as well as online credit score providers.

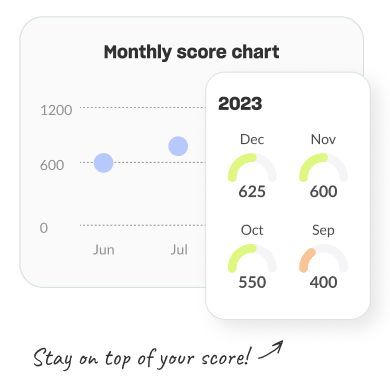

Generally speaking, credit scores range from 0 to 1,000 or 0 to 1,200, depending on the CRA. The higher your score, the better it is; conversely, the lower your score, the more improvement it requires.

With that in mind, what factors can greatly impact your score? Here are a few that you can look into.

Utility and credit repayments

It’s a common myth that only credit-related payments are recorded in your credit history. However, the truth is that your utility bills may impact your credit score more than you realise.

While utility providers do not report dues paid on time to your CRAs, they do report defaulted or missed payments once they reach certain amounts within a certain period.

Frequent credit applications

Multiple credit applications at once may be giving you more trouble with how to improve your credit score than you realise.

When you apply for a credit product, creditors and lenders perform a hard enquiry (also known as a hard check) into your credit history. Hard enquiries are recorded in your credit history, and several applications within a short period can signal to lenders that you may be experiencing financial difficulty.

Defaults and outstanding debt

Creditors and lenders will report any defaults to CRAs. This information will cause your score to drop and will stay on your credit history for a long time. This also applies to any court judgements regarding debt that have been made against you.

Credit is a serious financial obligation. When it comes to how to improve your credit score, it’s always best to manage credit and similar debts responsibly.