Another question you may have other than ‘What’s a good credit score?’ is ‘What does a good credit score get me?’

First off, borrowers with better credit scores often get access to better interest rates. Because lenders consider credit scores when determining interest rates for loans and credit cards, a good credit score makes you more likely to qualify for loans and credit cards with lower interest rates, which will save you money over time.

Since it is a measure of your creditworthiness, a good credit score also increases your odds of being approved for credit, such as mortgages, auto loans, or personal loans. Due to the considerable amount of money needed to fund such purchases, lenders are usually more willing to lend to individuals with a strong credit history and good credit scores.

Also, when you have a good credit score, credit card issuers are more likely to offer you higher credit limits over time. This provides you with greater purchasing power and flexibility, plus the exclusive rewards and benefits – think cash back, freebies, and more – that those higher credit card tiers tend to come with. Similarly, some lenders may offer higher borrowing amounts.

Once every three months, you can request a free credit report from major credit reporting bodies such as illion, Equifax, and Experian. With their stored financial data about you, they are able to generate your credit report and calculate your credit score.

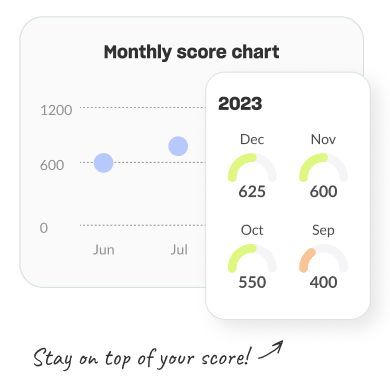

But since you can only request credit reports from these agencies once every three months, you won’t be able to track your progress from month to month.

Here’s how to check your credit score without spending a cent, and it’s a much simpler solution. The MONEYME Credit Score tool makes it easy to find out your score — plus, it’s free, fast, and comes with tips on how you can improve your rating.

All you have to do is download the MONEYME app for free. Tell us a few basic details about you, including your name, number, email address, date of birth, address, and optionally, your driver’s licence number, and we will handle the rest.

The MONEYME Credit Score tool will give you access to the very same information that banks and lenders assess to determine your creditworthiness and get on top of your finances.