Wondering how to check your credit score for free? Many may find it helpful to know that in Australia, there are three main credit reporting agencies: Experian, illion, and Equifax. Some may provide you with your credit score for free.

Another option is to go to an online credit score provider that offers the service for free. For safe and secure transactions, it’s best to avoid those that require you to provide your credit card information. At MONEYME, we use a secure process and only ask you for your name, phone number, email, date of birth, address, and driver’s licence (optional) to get started.

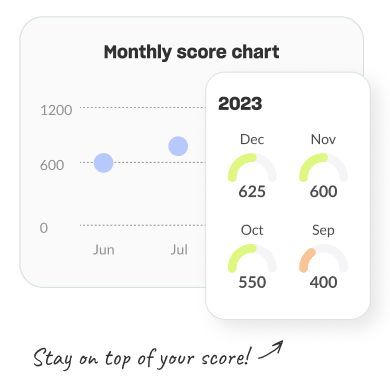

When you request a credit score check, each agency has a slightly different method to report your score, but all use a ranking system to assign a single credit score. Depending on the agency, the score falls between 0 and 1,000 or 0 and 1,200.

The higher your credit score, the better your creditworthiness and the less risk you pose to lenders, which makes it more likely for you to be approved for credit at lower interest rates.

If your credit score is low, you may get approved for a credit offer at higher interest rates or even have your application denied, depending on your specific situation. This is because a low credit score typically indicates a history of missed or late payments, numerous credit applications within a short period, or other irregularities related to your finances and debts.