Yes, a good credit score can make it easier to secure loans. It can also afford you better terms, like lower interest rates or higher borrowing capacities. Lenders view a high score as an indicator of lower risk, suggesting you’re more likely to meet your repayments.

Then again, having a low credit score doesn’t mean you’ll automatically be turned down for credit. Lenders consider a multitude of factors, not just your score. But it might mean you’ll need to stick to lenders who offer low credit score loans, which may have higher interest rates. That’s why maintaining a good credit score is beneficial – it can give you more financial flexibility and options.

Because credit scores play an important role in your personal finances, it’s crucial to be informed about what is a good credit score Australia-wide and to frequently monitor your own so that you can work on improving it if necessary.

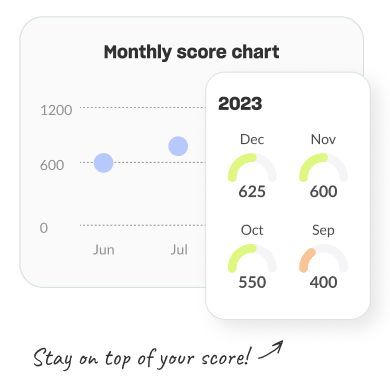

You can ask each of the credit reporting agencies for a free copy of your credit report every three months. But there’s an even simpler way to stay informed about your score: MONEYME’s Credit Score tool. With this tool, you can get a free, fast, and personalised credit score check in Australia via the MONEYME mobile app.

You’ll be able to see the same information that banks and lenders use to evaluate your creditworthiness. With this, you can find out how to increase your credit score fast if need be. Taking control of your finances begins with understanding your credit score.

With the MONEYME app, you can take that understanding a step further. You can get your credit score in minutes for free and receive personalised insights about your report. By giving you access to the same creditworthiness information banks and lenders use, the MONEYME app makes you a more educated consumer.

If you’re aiming for a strong credit profile, it’s vital to educate yourself about ‘What is a good credit score Australia-wide?’ and strive to meet or exceed those benchmarks. Thankfully, our app is loaded with tips and tricks on how to improve your credit score.

Getting started is as simple as downloading the MONEYME app, available in both the Apple and Google app stores. By entering a few simple details such as your name, number, email, date of birth, address, and driver’s licence number (optional), you can get a comprehensive understanding of your credit standing.

In summary, before applying for credit, it’s crucial to evaluate ‘What is a good credit score Australia-based lenders consider?’ This helps you determine your chances of receiving approval and favourable terms. Monitoring your credit score regularly through the MONEYME app also allows you to stay on top of your personal finances and work on improving your score if needed.