As there is a lot of information that makes up a single credit report, there are also many factors that cause low credit scores. If you’re interested in taking out low credit score loans, knowing these factors can help you determine the reasons behind your low credit rating and make more informed decisions.

One of the reasons for a poor credit rating is missed debt repayments. Any repayments you did not make two weeks after the due date are considered missed and are included in your report. It would still affect your rating even if you paid your credit provider after this timeframe.

In addition, non-repayment of debt, or a ‘default’, will also negatively impact your credit score. For example, your utility and phone service provider can report defaults to a credit reporting agency if you’re sixty days past your due date and if you owe them $150 or more. Just note that you’ll receive prior notification before your provider does this.

Applying for numerous credit opportunities can also adversely affect your credit score. Each application you submit, as well as inquiries made by providers, will be recorded on your credit report. And if you pursue multiple credit options within a brief period, such as low credit score loans, it may give agencies the impression that you are under financial strain.

Court judgments on your credit report indicate risk and can lower your score. Bankruptcy records also harm your credit score and remain on your report for five years from the bankruptcy filing or two years from the discharge, whichever is later.

Incorrect information can also lower your credit score. Outdated contact details make it difficult for lenders to reach you, which can lead to missed payments. Inaccurate entries on your credit report, including debts that don’t belong to you, can adversely affect your credit rating.

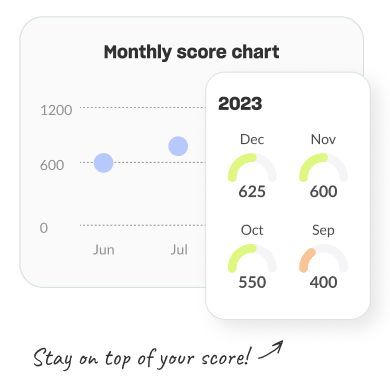

With all these factors mentioned, you should know how to check a credit score and request a report to ensure that all the information in your file is correct. Additionally, you can take the necessary steps to correct any inaccuracies that may improve your credit score.

And to improve your credit score, establish good credit habits such as meeting repayments on time and communicating with your lender if you face difficulties.