Prior to answering ‘What’s a good credit score, and how important are they?’ it’s important to first understand ‘What are credit scores?’

A credit score or rating is a numerical value that reflects the level of creditworthiness attributed to you as a borrower. In essence, your credit score condenses the information from your credit report into a single number.

Credit scores are significant for individuals for several key reasons. Generally, they indicate how well you have managed and repaid credit in the past, reflecting your responsible credit management.

When you apply for credit, providers typically request your credit file from credit reporting organisations. Your report as well as your credit score play a crucial role in the lender’s decision-making process. A higher credit score increases your chances of securing credit.

Additionally, your credit rating may influence the amount of credit a lender will make available to you and any other terms they may offer. Furthermore, credit scores can impact the interest rates you receive.

And in regards to the question ‘What are credit scores and what are they used for?’ they are not limited to personal loans or credit card applications. Your credit score is also a factor when you apply for other types of credit, such as mortgages, as well as job applications.

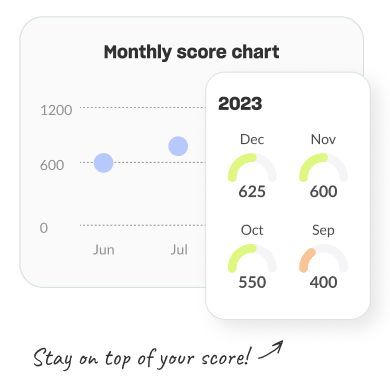

Now, let’s answer ‘What are credit scores, and what is a good credit score range in Australia?’

Credit scores range from 0 to 1,000 or 0 to 1,200, depending on the credit reporting agency. The three main credit reporting bodies in the country are Equifax, Experian, and Illion. Each organisation follows its own credit scale when measuring how good a credit score is.

Equifax provides the following credit score classifications:

- Good: 661 to 734

- Very good: 735 to 852

- Excellent: 853 to 1,200

Moreover, illion uses the following credit score classifications:

- Good: 500 to 699

- Great: 700 to 799

- Excellent: 800 to 1,000

Lastly, Experian categorises credit scores as follows:

- Good: 625 to 699

- Very good: 700 to 799

- Excellent: 800 to 1,000

Given the varying scales used by different credit rating organisations, the best way to define a good credit score is by assessing your situation when applying for credit. This is because providers have their own criteria for approving a credit request. Additionally, your desired borrowing amount can influence whether credit providers consider your score sufficient. Larger amounts may require a higher credit score.