The three main credit reporting agencies in Australia, Equifax, Experian, and illion, may have different information about you. On the other hand, online credit score agencies use data from different organisations to calculate and get your credit scores. So if you’re looking up terms like ‘good credit score Australia’, it’s worth noting that different agencies may provide you with different scores.

To ensure that you’ll get an accurate rating from online credit score agencies, you must first check if the details on your credit report are correct. You’re eligible to receive a free credit report once every three months from the credit reporting bodies we mentioned.

It’s advisable to request a copy of your file from each organisation so you can compare and determine if there are any significant discrepancies or errors, so they can correct them accordingly.

And to end your search for terms like ‘good credit score Australia’, the MONEYME mobile app offers a simple way to be on top of your credit rating. With the Credit Score tool, you can view your ranking within minutes and for free.

You can download the MONEYME app from the Apple Store and Google Play. To ensure that we’ll provide you with the correct credit score, we’ll ask you to enter some information such as your name, number, email, DOB, address, and driver’s licence number (optional).

Figuring out how to check your credit score in Australia is as simple as that, and you’ll have access to the same information banks and lenders use to assess your creditworthiness. You don’t only get your credit scores for free; you will also have personalised insights into your financial standing.

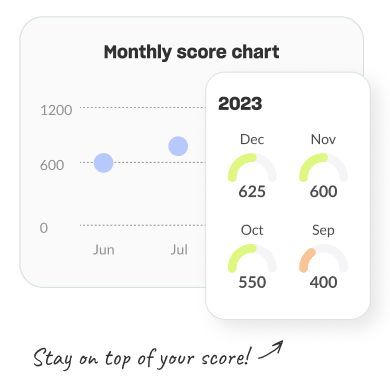

What’s more, the app features a monthly score chart and provides you with tips and tricks on how to work on your credit score. Even better, you can stay up to date with the special offers from MONEYME.