Whether you should get a personal loan vs credit card will depend on your circumstances. Personal loans are often used for larger purchases such as a car, and credit cards for multiple smaller purchases but these are not always the case. Usually, credit cards have a higher interest rate than personal loans and there is a minimum monthly repayment that you are required to pay back each month. You can also choose to pay off the whole outstanding debt each month which will mean you can avoid paying any interest at all, although most credit cards also have an annual fee that you’ll still have to pay.

Credit cards offer a lot of flexibility and convenience as you can draw on extra funds as you need them up to a maximum amount. The downside of having such easy access to extra money is that it can sometimes be tempting to spend more than you realise or purchase things that you don’t need, and you can be up for large interest payments if you don’t pay your balance back in full. Although the good news is, credit cards often come with an interest-free introductory period where if you make the minimum monthly repayments, you’ll need to pay no interest at all during that period.

Unlike with credit cards, personal loans require you to decide exactly how much you want to borrow upfront. This means you won’t be as tempted to spend more once you’ve taken out the loan. And if you get a variable rate personal loan rather than a variable rate personal loan, you’ll know what your monthly repayments are going to be each month which makes it easier for budgeting. The interest rates for personal loans are usually lower, and if you have a lot of different debts taking out a personal loan for debt consolidation can be a good idea to reduce the overall cost of the loan.

You be wondering, is it easier to get a personal loan or credit card? How easy it is to get either a personal loan or credit card will depend on your particular financial situation and credit score as well as the terms and conditions of the bank or lender. Personal loans can be hard to get if you don’t have a good credit rating but there are low income personal loan options available too. It is worth shopping around and doing a personal loan comparison as well as comparing the different credit card options so you can find the best deal for you.

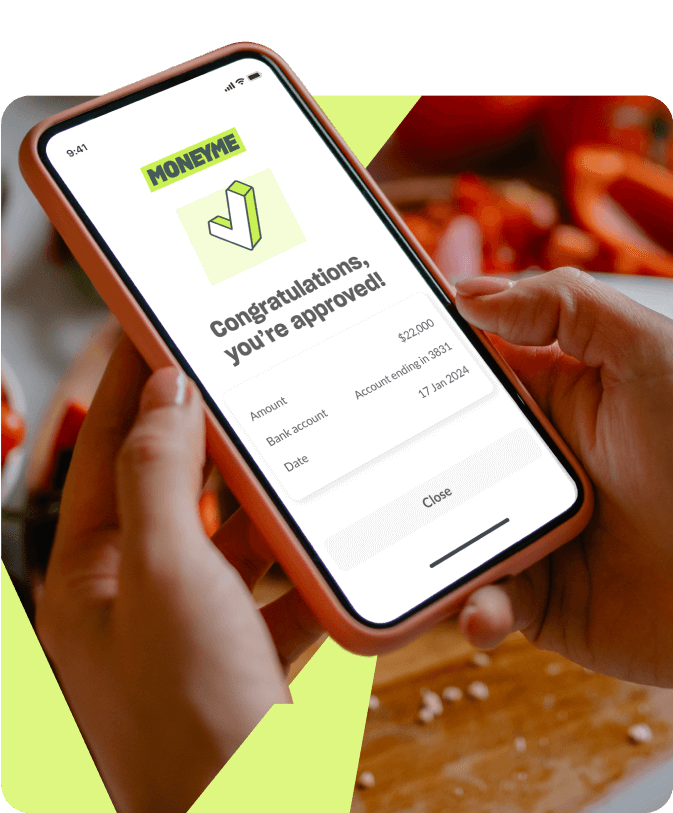

If you decide to go with a personal loan, MoneyMe personal loans online start from a low rate of $8.99 per annum, and you can borrow up to $50,000. With the quick online application process, depending on who you bank with if you submit your loan application during business hours the money could be in your bank account in less than an hour. With our same day loans, we’re completely upfront with no hidden fees or charges, and we don’t charge early exit fees.

If you decide a credit card is best for you, MoneyMe has a low rate Freestyle Virtual Credit Account that is powered by Mastercard. This is just like a credit card, but even better. It will give you instant virtual credit of up to $20,000 and you can start using it straight away once it is approved. You no longer need to wait for your credit card to arrive in the mail, as it is all done digitally. If you want to use tap n pay in-store, you can simply add your Freestyle online credit card to your mobile wallet. Online purchases are easy too, you’ll find the credit card details in your MoneyMe account online. You also have the option to send money to your bank account. With a Freestyle Virtual credit card, you can also get 55 days interest-free on all purchases.

If you’re still having trouble deciding between a personal loan vs credit card, MoneyMe’s friendly and knowledgeable support team is available to assist you 7 days a week. Contact us today, and see how we can help you access the funds you need.