A modern way to access credit

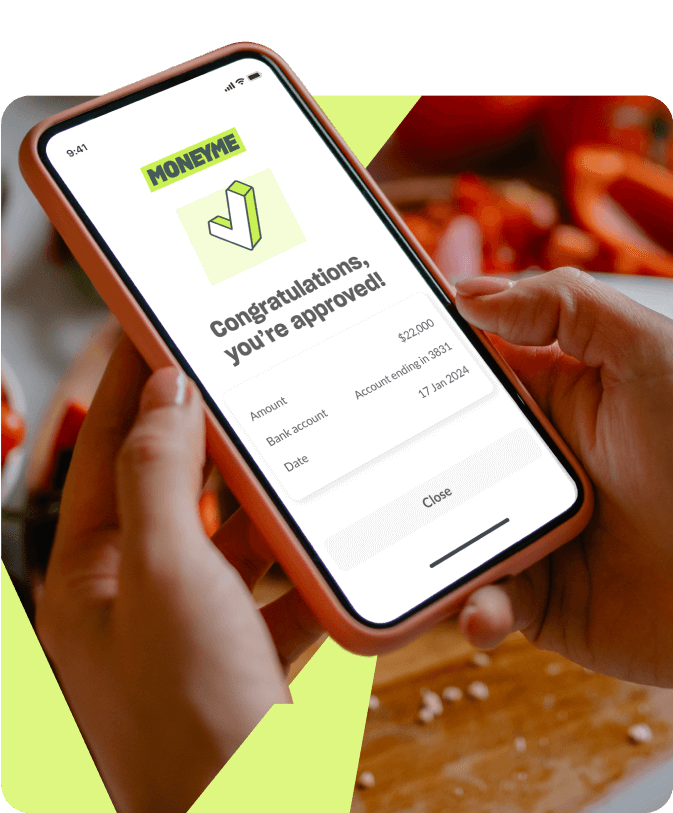

MoneyMe offers customers access to quick and easy personal loans Australia. As a money lender designed for Gen Now, we have an entirely online loan application and approval process that gives you on-the-go access to funds when you need it.

We offer a range of flexible credit options, such as personal loans, short term loans, as well as bond loans and rent assistance to help you out with rental costs. You can also opt for unsecured personal loans for purchasing big-ticket assets like a car or a boat. If you need access to quick loans or easy loans, you can always choose MoneyMe.

Apply online, get an outcome fast, and depending on who you bank with, have the funds in your account in just a matter of minutes. No lengthy paperwork, no several days of waiting. MoneyMe relies on an advanced proprietary AI-based loan management platform to give you a fair and accurate loan outcome.

Know how much you can borrow

If you’re looking for express loans, you might be asking yourself: “How much can I borrow?” Regardless of your desired loan amount, whether they’re small loans like a cash advance to tide you over or an unsecured personal loan like a boat loan for purchasing your dream water cruiser, you will need to know what your ideal rate is and what your credit provider is likely to offer you before you get started.

Use our personal loan calculator to help you budget for repayments and fees and charges like establishment fees and other ongoing fees. This will give you an idea of what kind of personal loan interest rates will most likely be charged and how your expected monthly repayments are likely to affect your current cash flow. A personal loan repayment calculator can also help you understand your options to refinance and ways to manage your monthly bills.

Use a personal loan repayment calculator to compare your repayments on variable rate personal loans Australia. The good thing about this calculator is it’s online, free and easy to use. You can play around with it by selecting your desired loan amount and your preferred repayment duration until you arrive at your ideal fortnightly or monthly rate.

Pay later with Freestyle

As an alternative, MoneyMe offers a modern credit product called Freestyle – a virtual credit account that lets you access to up to $10,000 to Tap n Pay in-store, shop online and transfer money straight to your bank account. It’s more than just a line of credit – it’s your spend now, pay later & credit card, all-in-one. Use it anytime, anywhere with Mastercard whenever you need quick cash to help pay your bills, cover unexpected expenses like car repairs or moving costs. Use it to get your daily fixes in entertainment, fitness or even just your morning coffee!

We see the whole picture

MoneyMe believes in responsible lending. As part of our credit check, we look beyond your credit score and consider a range of factors to make sure we are conducting an accurate risk-based assessment to arrive at loan terms and rates that are tailored to your personal circumstances. Apart from some personal and employment information, we also take into account your credit history, income, debt obligations and everyday living expenses.

With the new Comprehensive Credit Reporting (CCR), money lenders like us are able to see both sides of your credit history. Unlike the old credit report that used to only show your past defaults, late repayments or credit enquiries, the new credit statement reflects both the positive and the negative. This gives you a good opportunity to show your prospective lenders your initiatives to positively influence your credit score, such as making repayments for a small personal loan on time.

Along with some personal information, financial commitments and credit information that we have gathered through the comprehensive report, we also ask for your online bank details. So we could fast track your application, we obtain read-only snapshots of your banking activities for the last 90 days through a secure and trusted portal. It uses the same security-level encryption as your bank, so you are assured that your data is safe.

Get rewarded for good repayments

We love giving back to our customers. With the help of the comprehensive report, we can now finally reward you for your past positive repayment behaviours. If you make your payments on time, your credit score gets stronger and stronger, which means you can get access to lower rates and loan offers with better value. That’s how we do it here at MoneyMe.

Fast credit for big life moments

With MoneyMe, you can apply for larger personal loans Australia like student loans to cover university and course fees, a renovation loan for general home improvements, or a travel loan to book the trip of a lifetime. You can also apply for a wedding loan to get easy extra funds for your big day, or if you’d like to build a stronger credit history and gain access to better personal loan rates.

Manage your finance easier

Our mini loans are here to help you cover unexpected expenses while still waiting for your next paycheck. They may also help you manage your weekly or monthly cash flow with personalised loan terms and variable interest rates to make your repayments easier. And once you have a solid credit history with us, we may re-evaluate your credit profile. A good and reliable credit history helps you gain access to loans with better rates and flexibility, yielding more savings for you in the long run.

Enjoy a seamless online process

Our online application is low doc and user-friendly. We are the credit providers of Gen Now, and we take advantage of technology to assess millions of customer applications and verify information quickly and painlessly. No need for a shopfront because we do everything online. No need for face-to-face interaction, frequent phone calls or long queues. Just easy and on-the-go access to the cash you need, when you need it.

Once your application has been processed and you agree to the personal loan terms and conditions we have offered you, all you have to do is sign your digital contract and your money is transferred to your bank account straight away!

If you got approved for a Freestyle account, just download the MoneyMe app, add your Freestyle card to your Apple or Google wallet and create your security PIN. Once you’ve done all these, your Freestyle card is ready for everyday on-the-go use!

With our fast and easy personal loan Australia, you don’t have to wait for your next paycheck to come in for the things you can pay now. Our rates are designed to be fair, accurate and tailored to your personal circumstances. We won’t penalise you for making your repayments early. We also align your fortnightly or monthly repayments with your current pay cycle, so you won’t have to worry about getting caught with late fees! With MoneyMe, you are in control of your finances.

Experience a better way to borrow with MoneyMe. Apply now and get access to personal loan Australia up to $50,000 in minutes.

Personal Loans Australia

When it comes to personal loans Australia, MoneyMe knows just what you want as a consumer and credit product client.

For instance, all of the money we send to your bank account is brought about by no paperwork loans. We also provide you with a low interest rate for personal loans and a unique credit rating system that helps you save more money.

Be part of the online finance movement by utilising any of the premium credit options at MoneyMe. Experience the future today with just your mobile phone and our easily accessible app.

What is the lowest personal loan interest rate in Australia?

The lowest possible interest rate you could get with bank loans is just above 10% per annum. However, at MoneyMe, we provide you with interest rates from just 6.95% per annum.

Aside from that, we allow you to enjoy a number of other benefits. Here are some of the popular ones our new and old clients love:

- Same-day approval and money transfer

- User-friendly platform available for everyone

- Paperless online application process

Need we say more? Join MoneyMe today and be part of our growing family. Sign up for an account now to browse through our solutions – from a graduate loan to a personal loan for self-employed.

What is the best personal loan in Australia?

When it comes to top personal loans Australia, the best deals are those that provide multiple advantages while having minimal conditions in the application process.

This may be hard to come by when looking at a traditional lender such as a bank or work union. However, with MoneyMe, complicated online banking loans can be a thing of the past.

With our reliable services, you can have all sorts of benefits from just a short three- to five-minute application. Simply apply for personal loans using our smartphone app, submit basic information about your finances, and have your request be approved in no time.

It’s so easy, you can even finish the process with just one hand. Create a MoneyMe account today and enjoy a personal loan to pay off credit card or even a personal loan to buy shares.

Can international students get personal loans in Australia?

MoneyMe provides a personal loans Australia option that is even open to international students. Even those who are relatively new to the land down under can have money at an instant.

Regardless of the country you come from, you can apply for unsecured personal loans from us if you have all of the following qualifications:

- You are at least 18 years old

- You have a student visa (different from a bridging visa)

- You are making steady income here in Australia

If you tick all those requirements, then you are eligible to borrow funds from MoneyMe.

How to get a personal loan with a credit history that's not perfect in Australia?

Finding low credit score personal loans in Australia can be a tough task if you are only considering traditional lenders.

However, if you take a look at MoneyMe and fill out our personal loan application, you can get a fair chance at receiving a loan.

We cover a myriad of factors when you submit your request so you can rest assured that we look at the bigger picture. Moreover, our expert staff members take into account your income, obligations from debts, and living expenses so that we get to know your situation better.

At MoneyMe, you are more than just your raw credit score.

Can a non-resident apply for a personal loan in Australia?

You might think that the MoneyMe personal loans Australia option is only available for permanent residents. However, non-residents can also apply to our premium service.

To experience this one-of-a-kind personal lending, you have to be over the age of 18, have an approved student visa, and make a steady income in Australia.

However, it is important to note that MoneyMe only accepts loan applicants with a student visa and not those who have a bridging visa.

Can a person with citizenship approval avail a student loan in Australia?

While the MoneyMe personal loans Australia option seeks to give as many people the opportunity to get quick cash, there is still an eligibility standard that has to be followed.

For instance, if you have pending citizenship approval, you would have to wait until it is fully processed to avail of a personal loan from MoneyMe. Additionally, if you have a bridging visa and not a student visa, you cannot apply for a student loan from us.

However, other than those two points of concern, any Australian working resident above the age of 18 can enjoy all of our credit products and benefits.

Can I get a personal loan against my house in Australia?

At MoneyMe, we do not ask for security or collateral when you apply for personal loans Australia. In our digital financial service company, we won’t let you bite off more than you can chew as we are dedicated to providing responsible loans.

Here, we analyse not only your credit score but also all your possible sources of income, debt obligations, and living expenses. This way, we can form a comprehensive and fair loan amount decision based on the whole image, not just a zoomed-in portion.

Join the MoneyMe community today to get a loan from an understanding expert team who carefully observes.

Can a student visa get personal loans in Australia?

At MoneyMe, we pride ourselves on our ability to be flexible for all our clients. With our premium services, even those who have an approved student visa can pay for all types of charges using the money we lend.

However, even with this premium treatment, you must still keep in mind that an applicant must be above the age of 18 and have a consistent income to receive a personal loan.

If all those necessary conditions are present, then you can proceed with our completely paperless and online personal loans Australia process.

Just download our mobile app or hop on our website, input standard information about yourself, and wait for our approval. That’s just it – a personal loan fit for your budget.

Can you buy cheap land with a personal loan in Australia?

When it comes to personal loans Australia, you can count on MoneyMe to provide you with an option that can be used on anything you want, whenever you want.

With the personal loans we offer, you can purchase anything you can think of. From a cheap plot of land to medicine for your beloved pets – our quick, safe, and convenient money lending service will surely satisfy all your needs.

Sounds too good to be true? You don’t have to take our word for it. We are confident with what we do, that is why we even let you use a 100% free personal loan repayments calculator before your application.

With this tool, you will see that we have no hidden charges or fine print – just honest low rates and a user-friendly platform.

Sign up for an account today and be part of the thousands of satisfied MoneyMe clients.