Applying for a MoneyMe Freestyle card is a simple task anybody can do. Just follow these basic steps and have your application approved in just a few minutes.

First, make sure that you are eligible for our credit products. If you are a working Australian citizen aged 18 or older, then you can proceed to the next step.

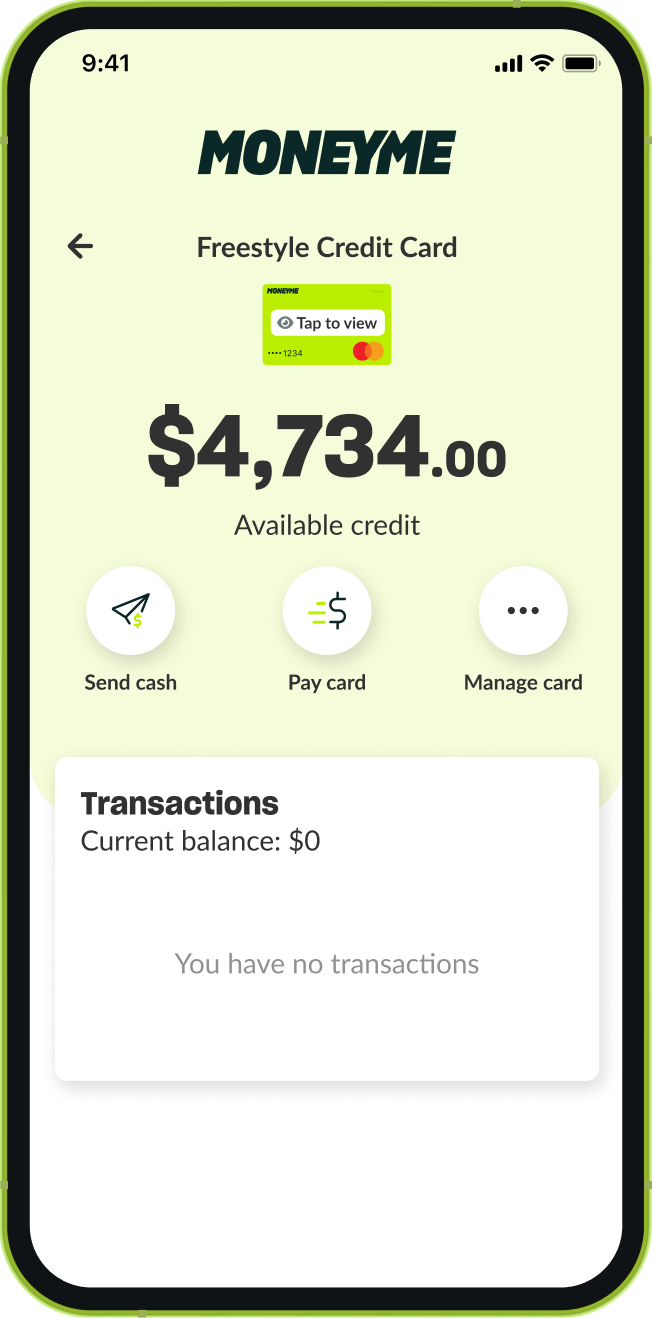

Next, download our mobile phone application available on all types of smartphones. Doing this will allow you to view your card details and receive notifications about your repayment status.

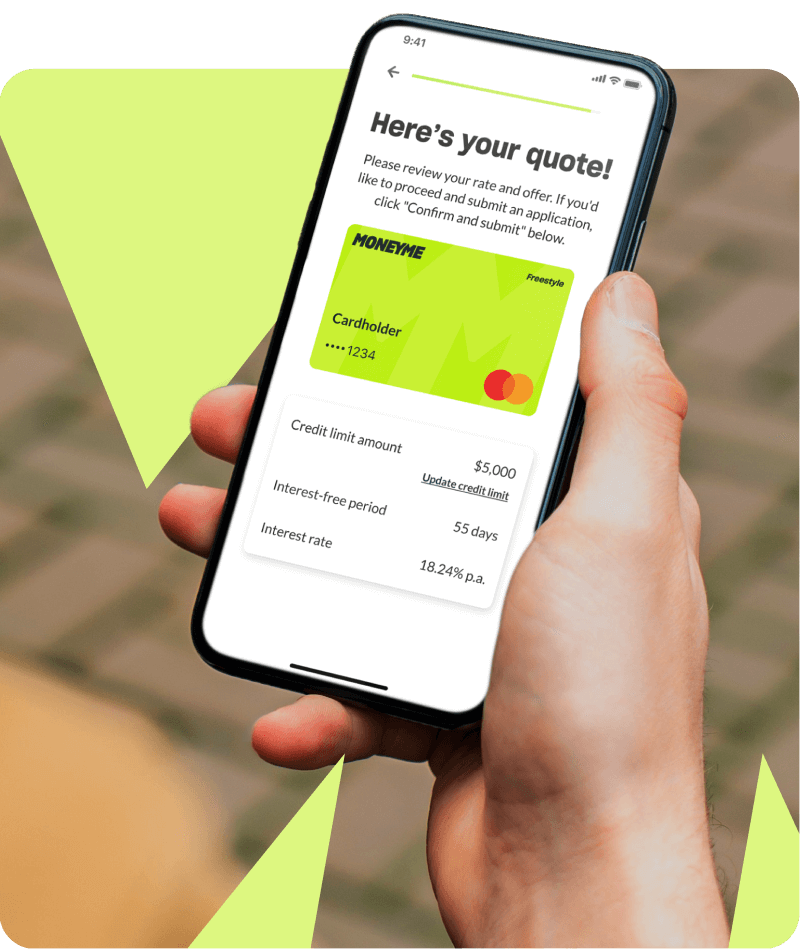

After the app has been installed, create an account and Freestyle card request. Here, you will have to type in information about your financial situation so that we can decide on a fair credit limit for you.

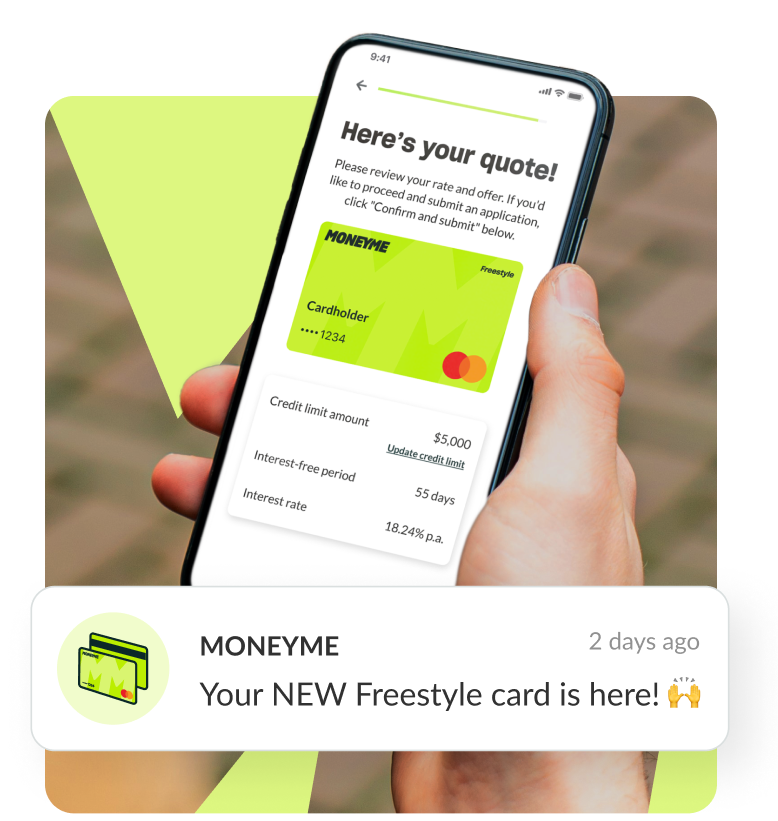

Lastly, wait for our expert MoneyMe team to approve your request, then instantly enjoy your fully functional virtual credit card.

With that simple process, say hello to our Freestyle option and goodbye to those clunky plastic cards. Join us here at MoneyMe and step into the future of money borrowing!