Financial opportunities don’t always present themselves. There are times when you have to work towards your goals and dream purchases, which is why people all around the country are searching for terms like ‘What is my credit score in Australia?’ or ‘how to increase credit score Australia’ on the web.

These days, it’s especially important to ask these types of questions as personal loans, cash advances, and credit cards become more prevalent. Your credit score, a numerical rating from 0 to 1,000 or 0 to 1,200, is calculated by reporting agencies based on the borrowing habits that make up your credit report. This will then be a measure of your creditworthiness or how much lenders see you as a risk.

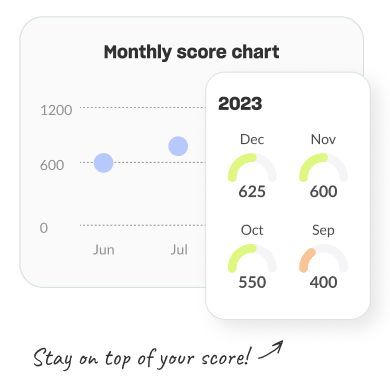

The good news is that, with us at MONEYME, you can now get a credit score check without having to worry about stressful and complicated steps. We understand the importance of credit checks when staying on top of your finances. However, we also recognise that this process can be daunting for most borrowers, and that’s why we’ve made things simple with our innovative Credit Score tool.

It’s 100% free and incredibly easy to use, making it so you won’t have to look up terms like ‘How can I check my credit score?’ and then ‘How to increase credit score Australia?’ shortly after. With just a few simple clicks, you can leverage our MONEYME mobile app, which you can get from the Apple App Store or the Google Play Store.

To get started, all you have to do is type in some standard contact details. We’ll need your name, number, email, DOB, address, and optionally, your driver’s licence number. Using the data you’ve provided, we can then proceed with an individualised credit check – one that will present you with the same information lenders and banks consider when they determine your creditworthiness.

What’s more, our MONEYME mobile app can even give you tips and tricks that’ll teach you how to improve your credit score, along with special offers. This will help you gain more insight into your specific financial situation and also understand what you can do to improve your chances of a successful credit application in the future.

By trying our Credit Score tool, you’ll get easy access to a summary of the following points:

- The amount of credit you’ve previously taken out

- Repayment history for any personal loans, cash advances, or other credit products

- What your present borrowing capacity is for credit products

- Your previous credit applications and their frequency

- Any disclosed court judgements, bankruptcies or defaults in your name

Having this comprehensive overview means that you can better take control of your finances and potentially boost your credit ratings gradually. Install the MONEYME mobile app today and put an end to your tedious search for terms like ‘How to improve credit score Australia?’ or ‘How to increase credit score Australia?’ on the web.