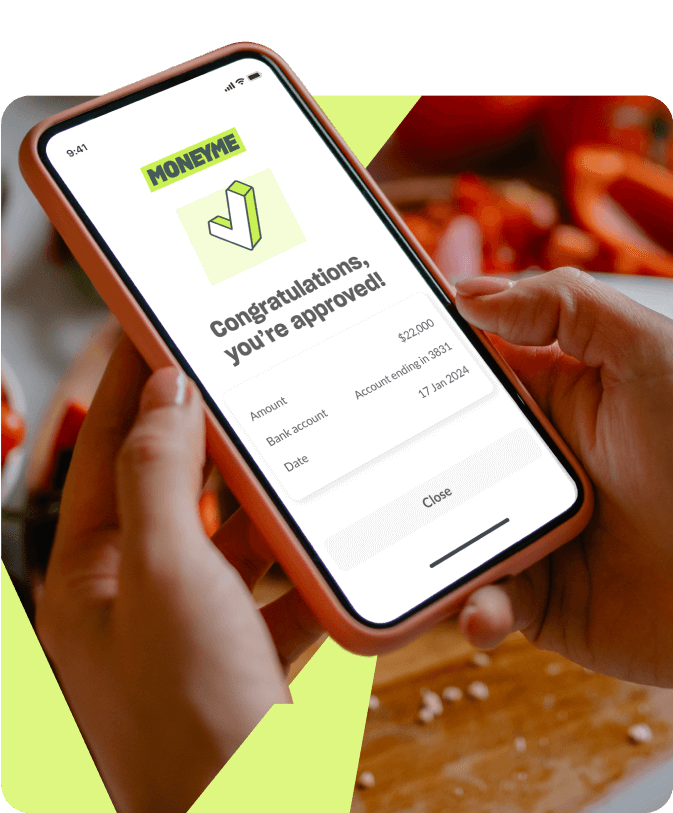

To apply for our unsecured car loan, you only need to fill out a short online application form. The whole process is simple and takes only a few minutes. You’ll just need to provide some basic information about yourself, including your name, address, date of birth, employment details, and income. Once you’ve submitted your application, one of our friendly loan consultants will assess it and get back to you with a decision within minutes. If you’re approved, we’ll transfer the money ranging from $5,000 to $50,000 straight into your bank account so you can access it as soon as possible.

Because an unsecured car loan doesn’t require any collateral, you need to prove your creditworthiness, which your credit report can reveal. Nonetheless, having a mark does not automatically mean that MONEYME will turn down your loan application. To come up with the fairest and most accurate lending decision, you need to prepare documents that will prove your eligibility such as proof of identity and proof of income that will support your entire financial situation, including your cash flow, and debt obligations, monthly income, and living expenses.

To assess your financial situation, we need your bank details so we can see read-only snapshots of your most recent bank transactions. In this way, we can evaluate if your requested amount is something that you can afford to repay on a regular basis without putting you in a tight financial position.

MONEYME offers unsecured personal car loans that come with more favourable repayment terms and lower interest rates than traditional lenders and banks in Australia. Offering competitive rates and financing options that are truly borrower-friendly is what matters to us.

Applying for the best car loans with MONEYME is easy, fast, and convenient, so why not get started today? Give us a call or send us an email. Our experts are here to help you every step of the way.