You’re ready for vehicle finance if you know you can afford to pay monthly car finance repayment. Owning a car and paying a loan both entail responsibility. When you know that you are financially capable, then that’s the time you can give it a go. MONEYME can help you make the right financial decisions so you can lead an easier and better life.

The best way to get a car loan starts with choosing the right lender. You deserve a financial service provider that is trustworthy and transparent in discussing the costs, interest rates, and terms when applying for a vehicle loan. MONEYME offers flexible financial solutions for all your needs with our range of credit services, including a personal car loan. Enjoy a fast and easy auto loan application with us today!

How does vehicle finance work?

Vehicle finance from an online lender like MONEYME allows you to take advantage of flexible credit services to buy a new car. If you can’t afford to purchase a car in cash, you can still drive your dream car with the help of a reliable and best car finance service that offers competitive and low-interest financing. If you’re thinking about applying for vehicle finance anytime soon, knowing how it works helps you use it to your advantage.

Know your credit score

Before you think about applying for vehicle finance, you need to review your credit score. Your credit score reveals how well you can pay for your loan. Online car loan lenders like MONEYME will do credit history checks as part of the application assessment. Credit scores can positively or negatively impact your vehicle loan. This can also affect the total amount of your loan and monthly payments. Online lenders will usually have different criteria in determining the amount of loan that you can borrow. At MONEYME, we use a loan rating score from A1+ to A5 based on your credit history.

A high credit score will allow you to avail of low-interest rates and low monthly payments. MONEYME rewards clients with a good credit history by providing favourable car finance deals. So even before considering vehicle finance, you may need to update your credit history report and improve your credit score by paying on time.

At MONEYME, you can still apply for vehicle finance even if you have a low credit score. When we make loan assessment decisions, we look at the whole picture. We consider other factors such as your employment details, income, and personal circumstances in reviewing your loan application. The new Comprehensive Credit Reporting also allows us to see both your positive and negative credit data. MONEYME does not automatically decline anyone who doesn't have a pristine credit file. Applying for a vehicle loan online becomes more flexible and possible for everyone to enjoy.

Compare interest rates

Since lenders have different criteria for assessing loans, interest rates vary. Once you’ve borrowed money to buy a car, you will repay the lender with fees based on loan interest. Interest rates show as a percentage of the loan amount and the charged rate. The loan amount will add a per annum interest rate that will largely affect your monthly payment. Lenders define fixed interest rates based on your credit score. It would be best to compare the interest rates of lenders before you sign that loan offer. A high credit score increases your chances of getting guaranteed financing.

Choose a workable loan term

When borrowing money, there are terms and conditions applied. The total interest fee and monthly payments depend on the loan’s repayment period, known as the loan term. Loan terms in MONEYME vary from one to five years.

You will need to consistently pay and complete the whole duration of the loan term to maintain a good credit score. Loan terms also determine when to pay the loan at a specific date every month. Missing monthly payments may add penalty charges, so avoid it as much as possible. You can avoid late payments by setting automated monthly deductions, creating a due date alert, and keeping track of all your bills and debts.

How to qualify for vehicle finance?

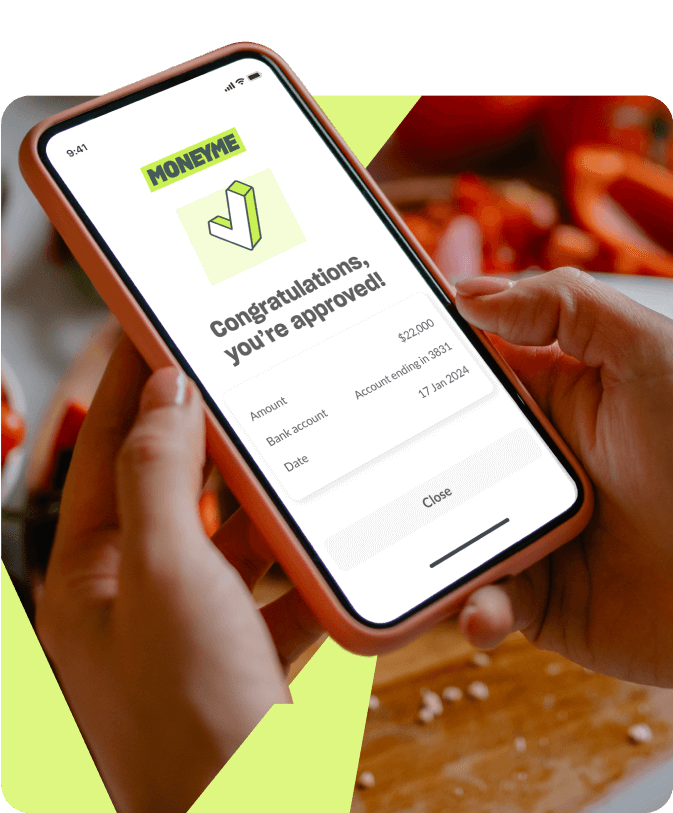

To be eligible for our cheap car finance at MONEYME, you have to be an Australian resident, at least 18 years of age, and currently employed. MONEYME’s personal loan eligibility lending criteria consider your income, expected living costs, and loan rating. To determine your eligibility for a car finance quote, you can use our free online loan repayment calculator to know how much you can afford to borrow. If you meet these vehicle loan eligibility requirements, you can submit your loan application. MONEYME provides fast and easy applications done online and completed in three to five minutes. Thanks to our smart technology, it won’t take long for you to find out if your same-day loan has been successful.

How to apply for vehicle finance?

MONEYME makes applications for vehicle finance convenient and accessible. All you have to do is apply using your mobile phone and the internet. First, you need to sign up for the application form online. Filling out details will only take you three to five minutes. You need to provide information about the following:

- Employment status

- Income and expenses

- Credit history

- Reason for borrowing

- Expected loan amount

Experience a paperless application and electronically sign the form to process your car loan. After completing all the necessary information, you can immediately submit your application. Next, we will assess your application, and you only need to wait for our same-day approval before getting your funds. Your credit score will determine the final amount, interest rate, loan term, and monthly repayment. Once you get approval, we will send you a loan offer, and if everything goes well, you can immediately get your funds directly into your bank account the same day.

Stop chasing the dream of driving your dream car and make it happen today! MONEYME gives you access to low interest rates and monthly payments. Our competitive and flexible loan offers better value for your vehicle finance. Apply for a car loan today and borrow between $5,000 and $50,000. Our tech-driven online application process will only take you minutes to complete – with absolutely no hassle! Apply for a loan today or contact us for more details.