Firstly, it can help you detect any errors or fraudulent activities that may have occurred on your credit report. You can identify any mistakes, such as incorrect personal information, late payments, or unauthorised credit inquiries. These errors can have a negative impact on how lenders and institutions view you, and when you correct them, you can see how to improve your credit score.

Secondly, monitoring your credit score ratings can also alert you to any changes that could indicate identity theft or other unauthorised activity. For instance, if you notice a sudden drop in your credit score, it could be a sign that someone has opened an account in your name without your authorisation. By catching these changes early, you can take steps to prevent further damage to your credit score and minimise any financial losses.

Moreover, monitoring your credit score can also give you an idea of how lenders perceive you. Your credit score is a reflection of your creditworthiness, and a higher credit score indicates that you are more likely to be approved for loans and credit cards with favourable terms and lower interest rates.

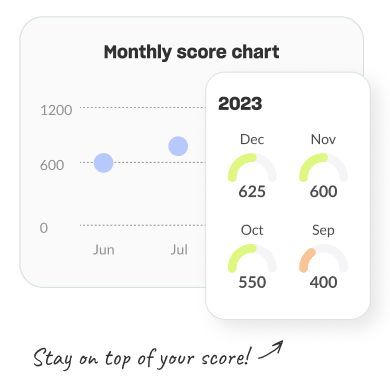

By knowing your score, you can make more informed decisions regarding credit and other financial activities. You can also take steps to improve your credit score, such as paying bills on time, paying down debt, and disputing errors on your credit report.

These benefits are just some of the reasons why people search for ‘check my credit score Australia’.