If you have ever applied for a loan, line of credit, or another credit product, you will have a credit record made about you.

Your credit report is a statement with information that paints a picture of your financial history. It has all the standard information to identify you as you – i.e., your name, place of birth, where you reside, and your employer.

This report outlines your past monetary obligations and how you have addressed them. It details whether the payments were made in a timely fashion, if any were missed, or if there was a case of non-payment or default for any credit obligations.

If you have struggled with repayment in the past, it may also include details about instances where you have missed payments, been taken to court, or filed for bankruptcy.

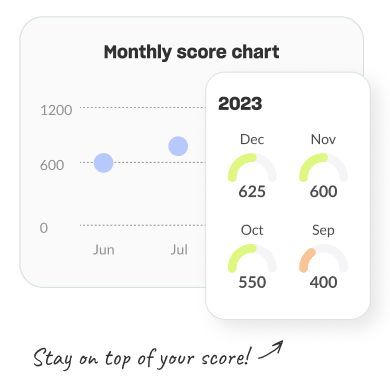

Your credit score, used by lending institutions to judge your financial reliability, includes all of this information. Since credit scores are used to measure one’s creditworthiness, having a good score means you are more likely to be approved for credit with better terms and lower interest rates. This is why so many people look up ‘my free credit score’ online.

Have you been looking up ‘What’s a good credit score in Australia?’ online? Some credit reporting agencies use a scale from 0 to 1,000, while others use a scale from 0 to 1,200. At Equifax, the following scale is typically used to evaluate your creditworthiness:

- 0 to 459 = Below average

- 460 to 660 = Average

- 661 to 734 = Good

- 735 to 852 = Very Good

- 853 to 1,200 = Excellent