Before we tackle the best credit score check Australia has to offer, let’s first get into how it works.

Credit checks involve accessing your credit report from a credit reporting agency. Your report contains your payment history, credit accounts, outstanding debts, and other relevant financial information to assess your creditworthiness.

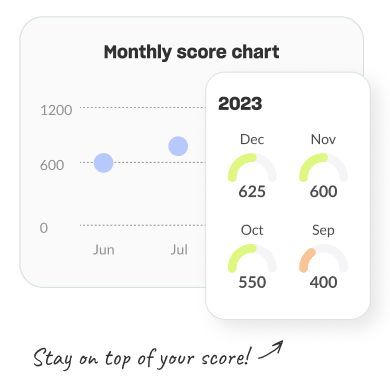

It also includes your credit score, which is a numerical representation of your creditworthiness. It serves as an assessment of your ability to manage credit and repay debts. Lenders and financial institutions utilise credit scores to evaluate the risk associated with lending money to a particular borrower.

When considering the best credit score check Australia-wide, it’s important to remember that credit checks come in two forms: hard and soft.

A hard credit check is the kind done by banks and other lending institutions when you apply for credit, such as a loan, credit card, or mortgage. It involves a thorough examination of your credit history and can leave a mark on your credit report. Multiple hard credit checks within a short period can have a negative impact on your credit score.

A soft credit check, on the other hand, is a less invasive inquiry that provides a snapshot of your credit history without leaving a lasting record. These checks can be conducted by potential employers, landlords, or more commonly, anyone who wants to review their own credit information. Soft credit checks do not impact your credit score.