Your payment history is one of the most important factors affecting your credit score. Making a late payment or defaulting on a loan, credit card, or bill can drastically affect your credit score.

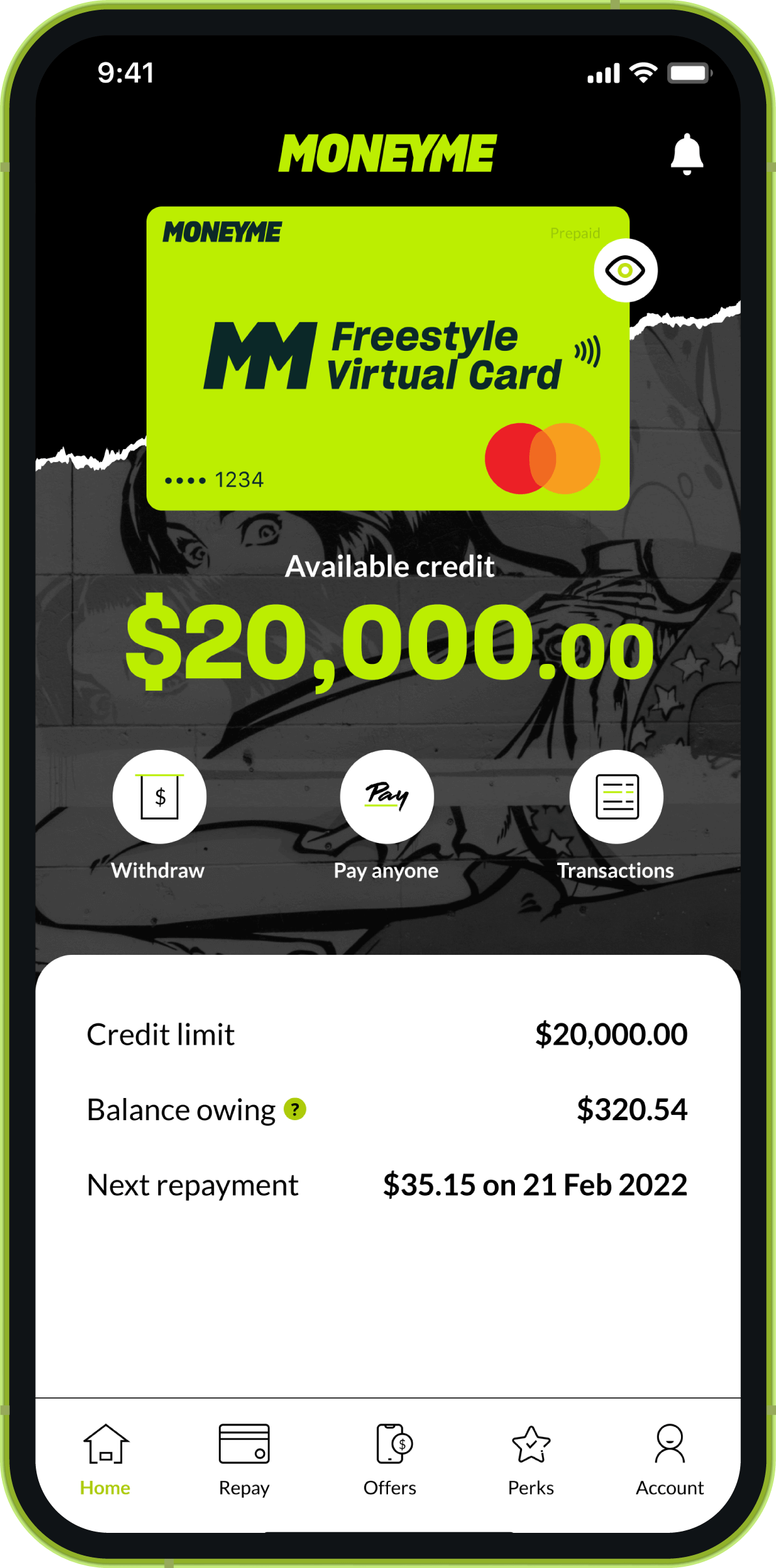

Using most or all of your available credit limit can also indicate financial stress and lower your credit score. A good rule of thumb for those looking up ‘free credit score Australia’ would be to try and keep your credit card balance below thirty per cent of your available credit.

It’s possible for your credit score to be lowered if you make frequent credit applications, which can raise concerns about your financial stability. Each application usually entails a hard credit inquiry, which could possibly have a small negative impact.

Closing old credit accounts can reduce your overall credit limit and shorten your credit history as well.

If you default on loans or go into collections on debt, your credit score can be severely damaged. If you are able to, it’s important to address any outstanding debts and work towards resolving them.

Major negative events, like declaring bankruptcy, having your house go into foreclosure, or having your car repossessed, can have a significant, long-lasting impact on your credit score. These events usually leave a stain on your credit report for several years.

Errors on your credit report or a history of fraudulent activity can, of course, affect your score. For those who have been looking up ‘free credit score Australia’ because they’re curious about their credit score, it’s important to always submit complete and accurate information whenever you seek a line of credit and to dispute any incorrect information on your credit report as soon as you spot it.

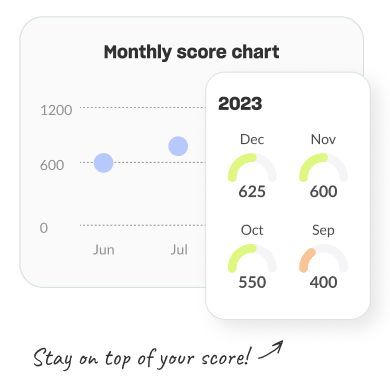

Fortunately, your positive credit behaviours are also reflected in your credit report. These include your consistent and timely repayments, which provide lenders with a clearer borrower profile. Lenders won’t have to make a decision based on a rough patch you might have gone through four years ago but are well past.

The more positive your credit behaviours, the higher your credit score. This means the better your chances are of gaining approval for the credit you’re applying for since lenders use it as a measure of creditworthiness.